Zomint Blog

Zomint Blog

Zomint Blog

Should You Invest in IPOs ?

Nov 10, 2025

📢 IPO Season Is Here!

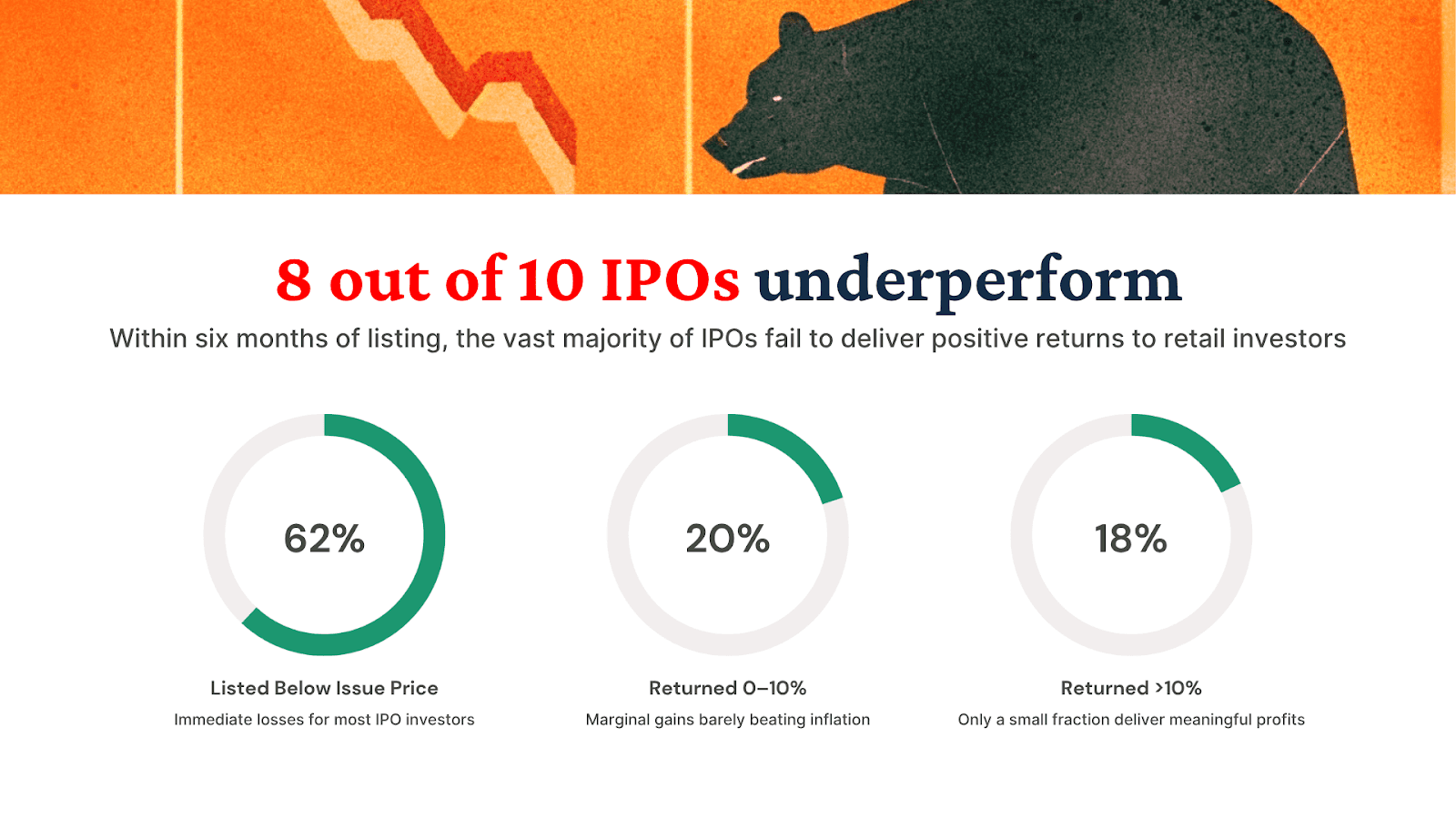

Everyone’s rushing into IPOs again. Lenskart and Groww have already made their debut, while Physics Wallah, boAt, Meesho, and many more companies are now gearing up to hit the market! But here’s the real problem — everyone’s blindly chasing the hype, ignoring the actual financials, and that’s why most investors are losing a lot of money on IPOs.

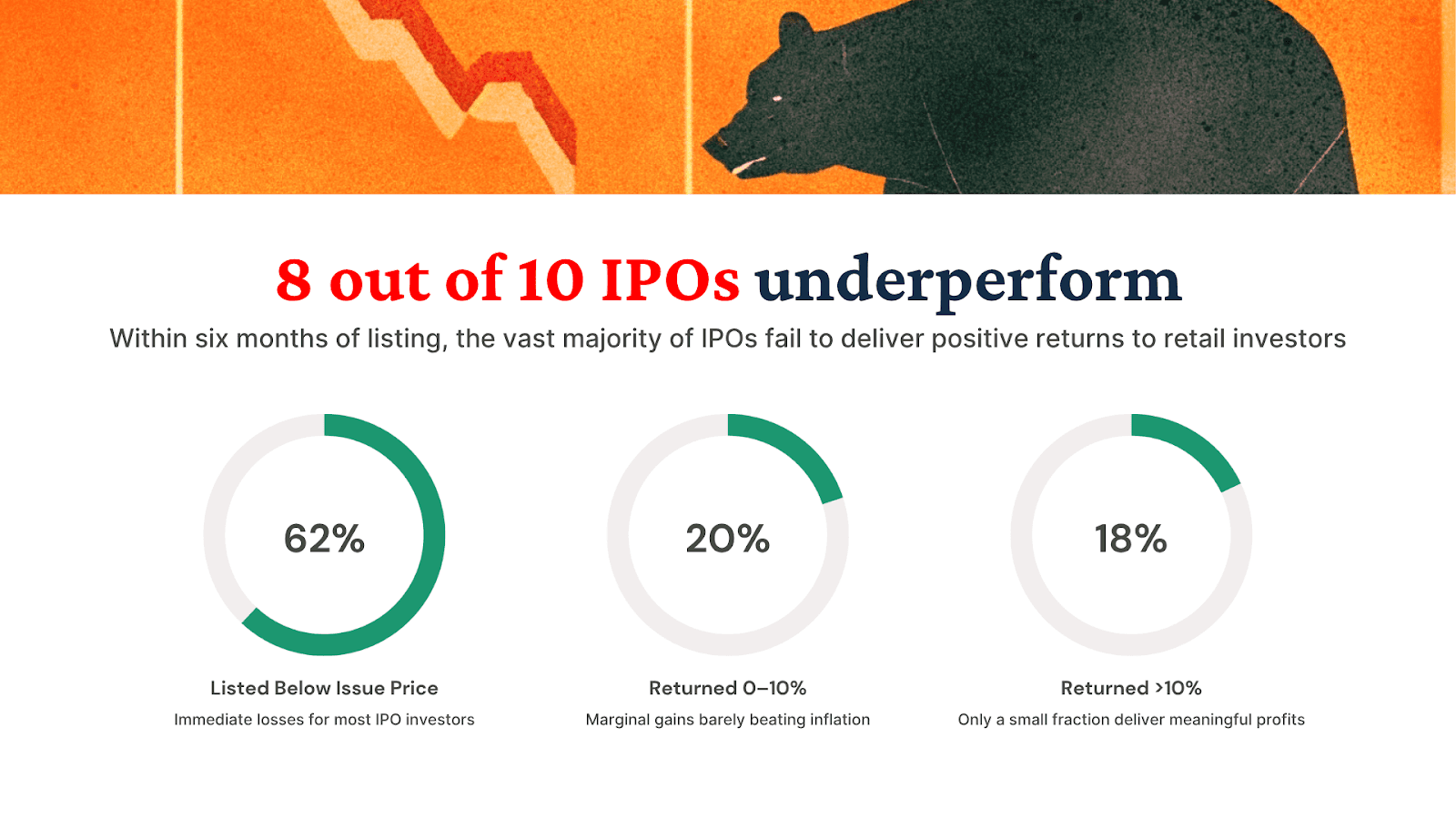

In fact, 8 out of every 10 IPO underperform, making this more of a new-age pump-and-dump scheme.

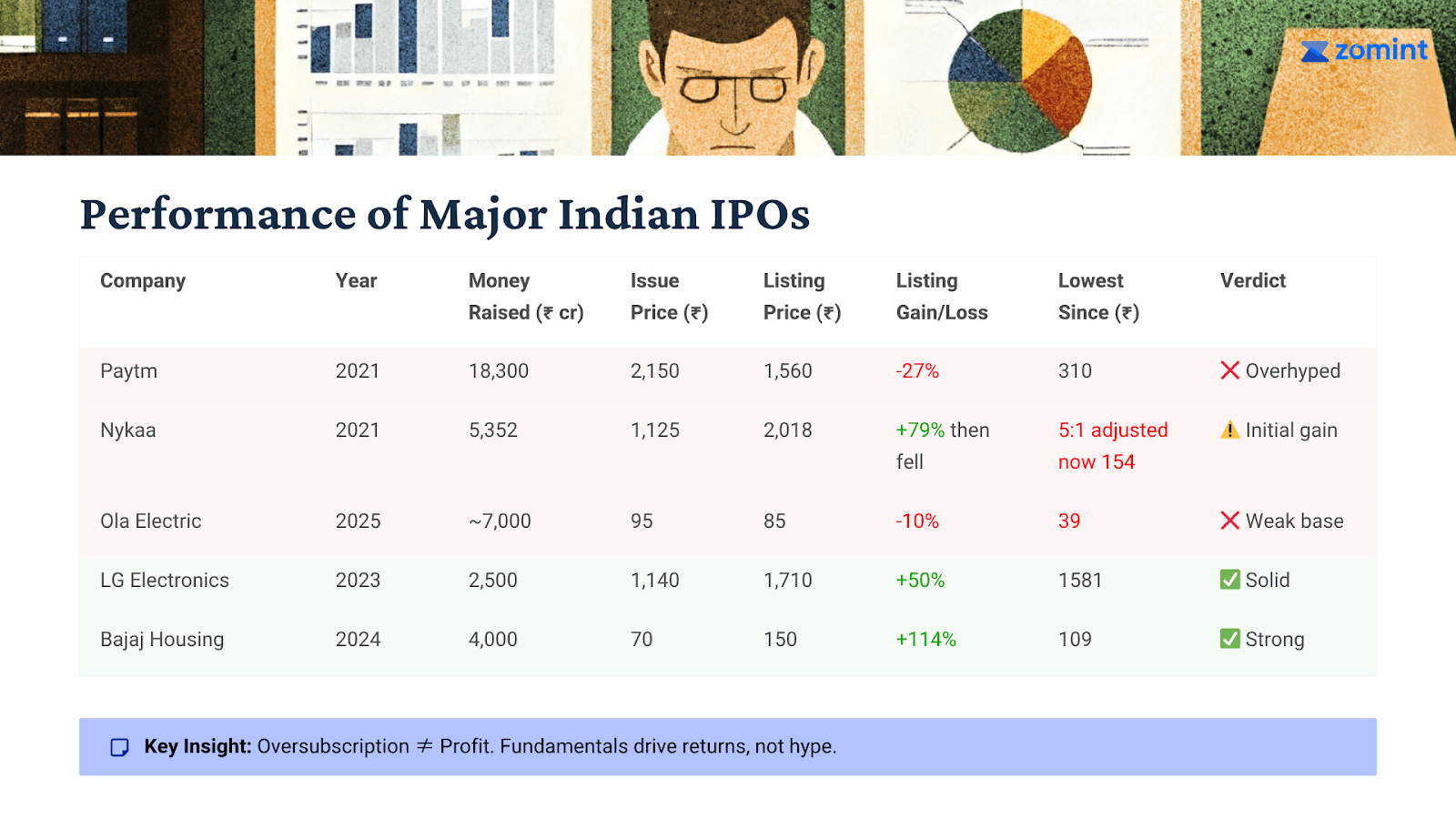

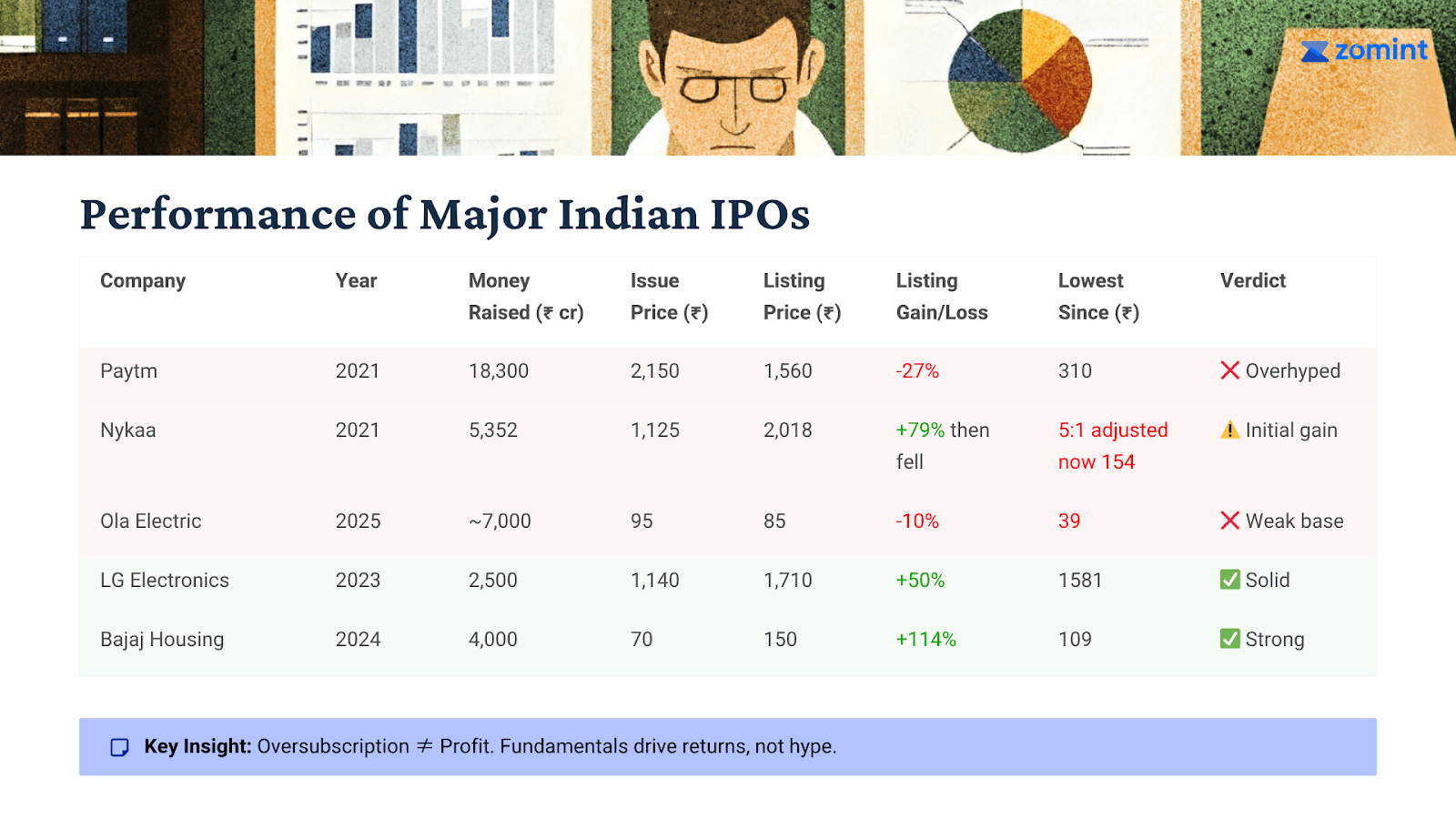

You probably remember the Nykaa, Paytm, or Ola Electric IPOs. All three had one thing in common: they were highly oversubscribed yet performed poorly, resulting in huge losses for many investors.

But is this always the case?

Let's again look into some other companies:

LG Electronics India gave a 50% listing gain. Launched at ₹1,140, it is now trading at ₹1,715+.

Bajaj Housing Finance Ltd: Issue price ₹70, listing price ₹150, listing gain 114.29%.

In this case IPOs have yielded amazing returns.

So the crucial question now is: Should we invest in them, and if so, how do we choose the right ones?

This newsletter will answer all these questions. We'll decode the Indian IPO market completely and clear all your doubts so you can invest with full knowledge this IPO season.

What Exactly Is an IPO?

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time, allowing everyday investors to become part-owners of the business.

In simple terms, an IPO is how a company transitions from being privately owned (by founders, promoters, or venture capitalists) to being publicly traded on stock exchanges like the NSE or BSE.

Why Do Companies Go Public?

Companies choose to go public for the following three reasons:

Raise capital for expansion, new projects, or debt repayment.

Provide an exit route for early investors and venture capitalists.

Enhance credibility and visibility in the marketplace.

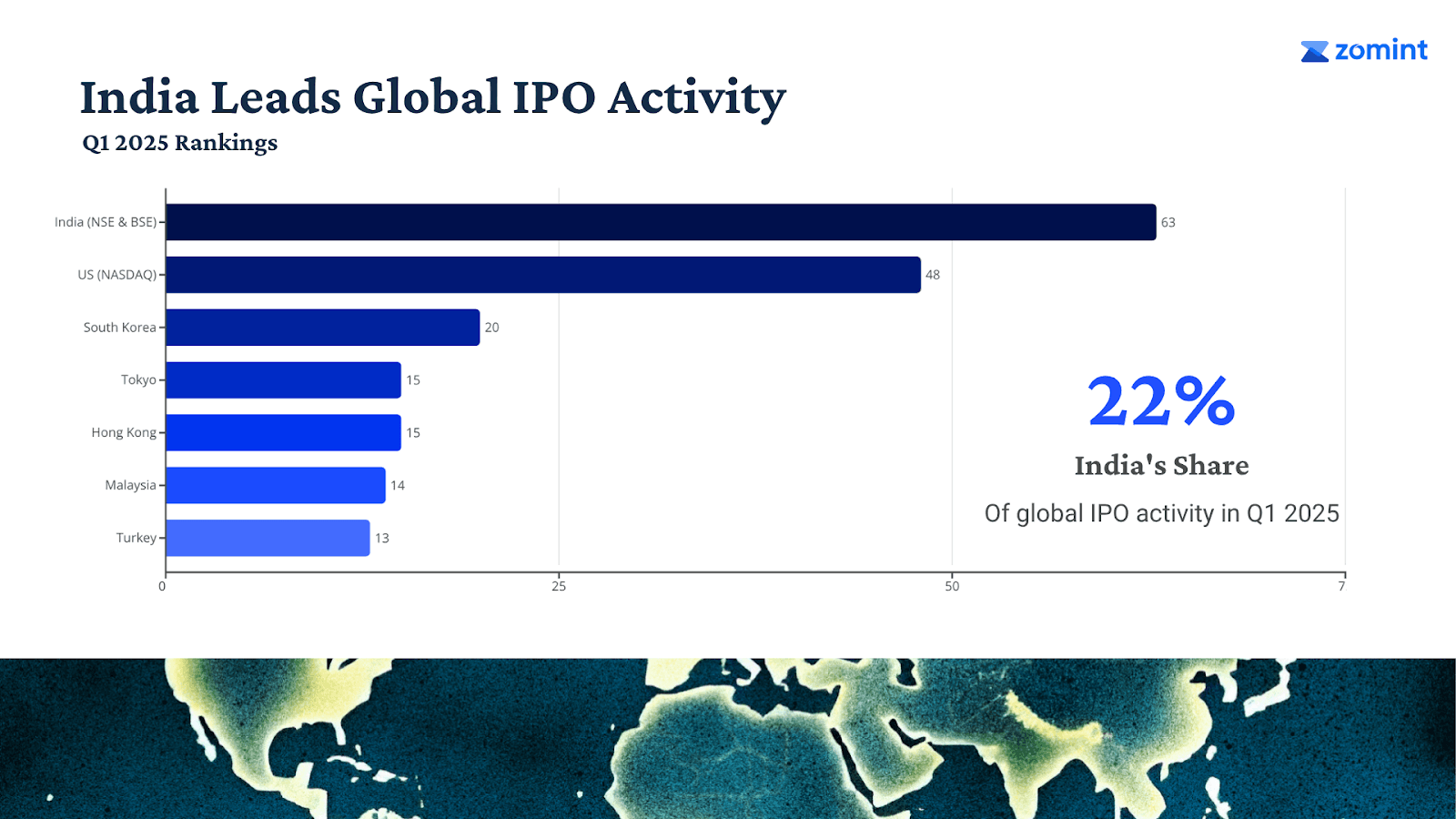

In recent years, this process has become a huge trend in India. Many people now see IPOs not just as investments, but almost like a chance to win big quickly. With so much social media buzz and heavy oversubscription, India’s IPO market has taken off — raising about $2.8 billion in just the first quarter of 2025.

Because of this massive interest, India now stands among the top countries in the world for IPO activity.

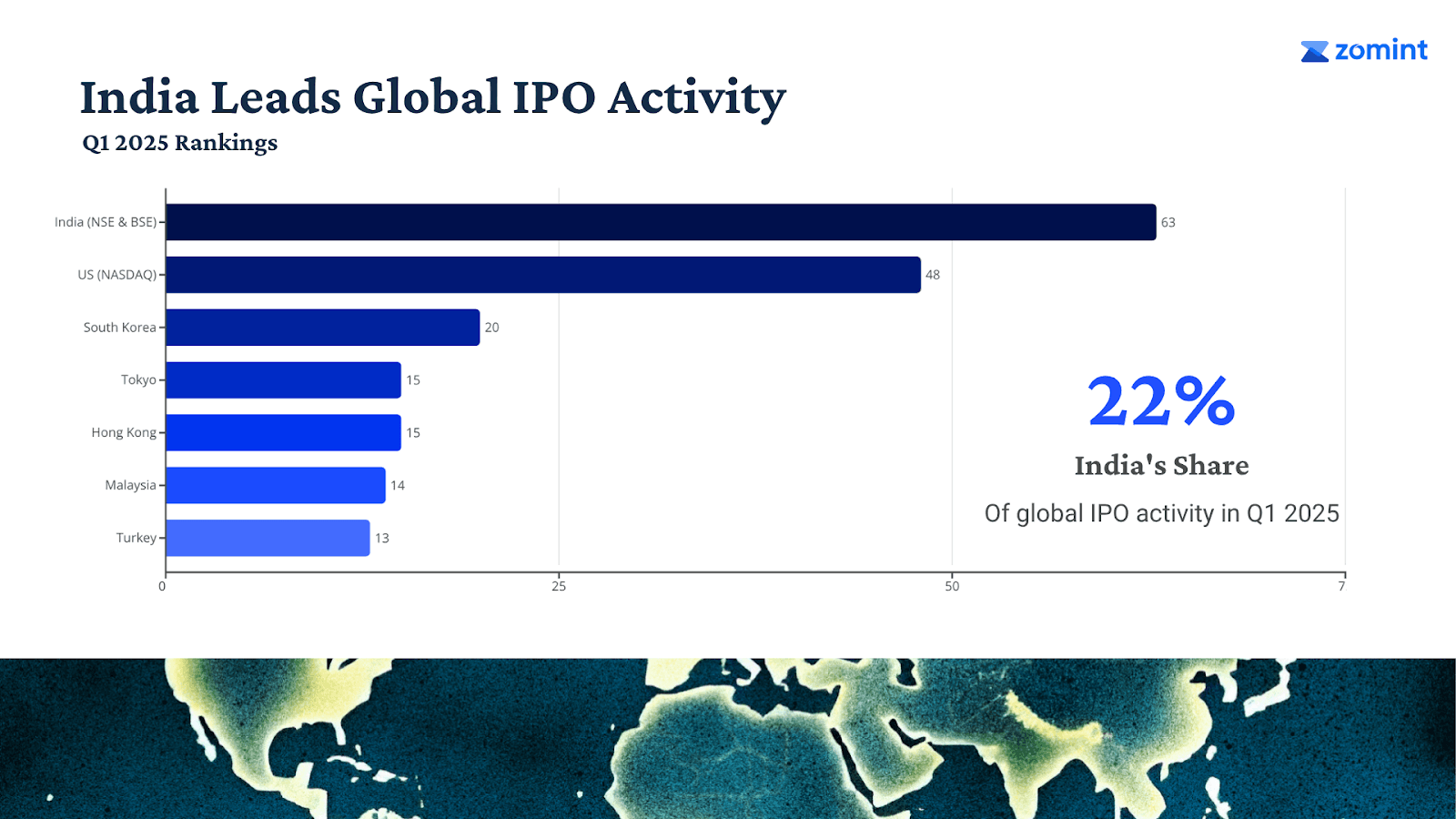

The data below shows that in the first quarter of 2025, India is leading the world in the number of IPOs launched.

With all this hype around IPOs, it’s easy to feel like you’re missing out. But here’s the real question

Should You Invest in IPOs?

The answer to this question is mostly no—at least not blindly.

We don't recommend most retail investors to invest in IPOs because many buy simply because a friend told them to, out of FOMO (Fear of Missing Out), or due to social media hype. These are the worst reasons to buy IPOs.

If you want to invest in IPOs, you have to do proper, deep-down research for each one and then decide whether it makes sense to invest or not.

Let now discuss what you should do before investing in any IPO.

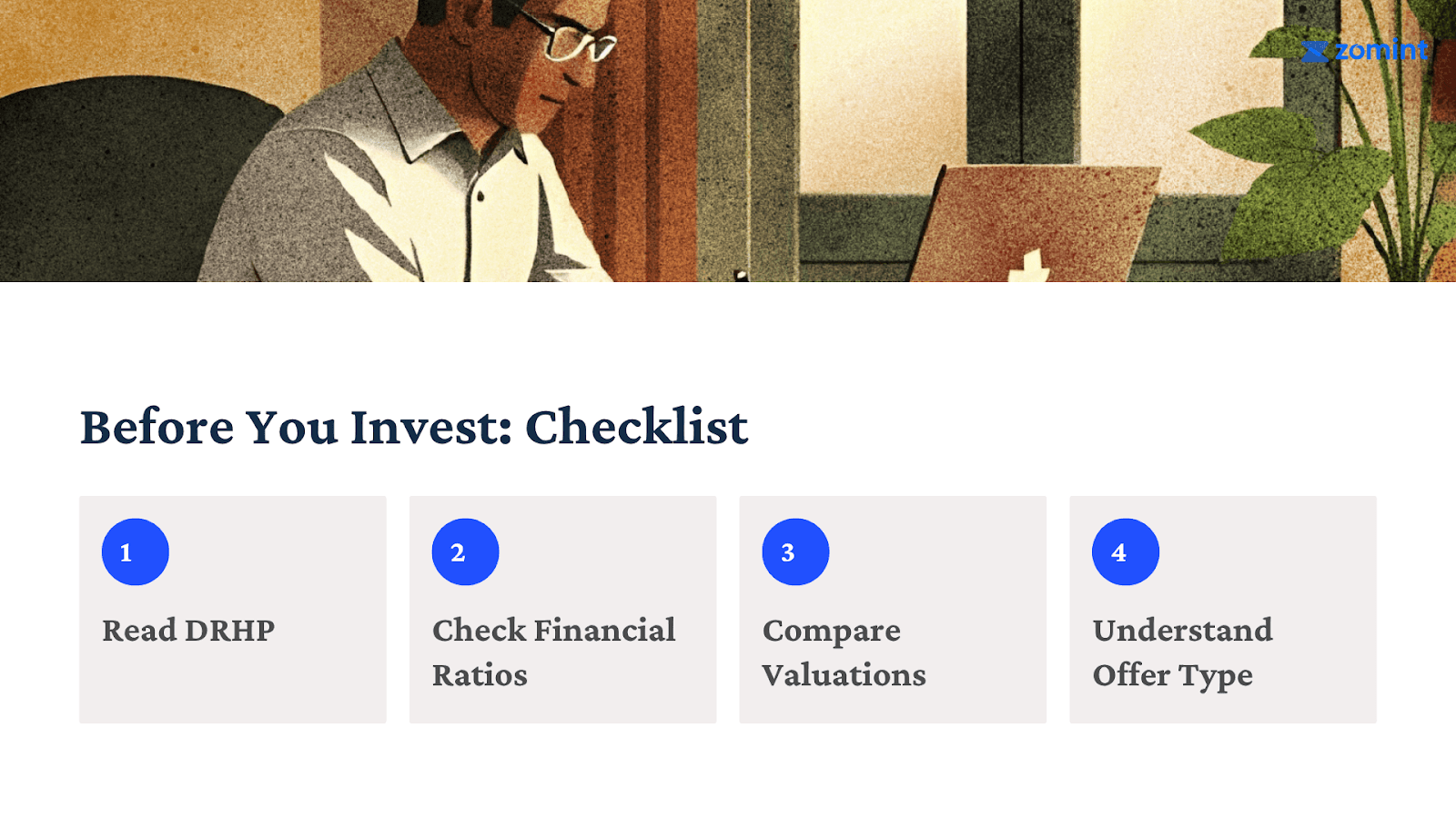

What Should You Do Before Investing in an IPO?

1. Read the DRHP (Draft Red Herring Prospectus)

This is the official document filed with SEBI. It explains everything about the company—business model, financials, risks, and how the IPO money will be used.

Shortcut: Check the summary on SEBI / NSE / BSE or financial portals like Moneycontrol. Reading the DRHP will give you the basic idea of what the IPO is all about.The next step is to check:

2. Analyze Financial Performance

Key ratios to look for:

Revenue growth

EBITDA & Net Profit margins

Debt-to-Equity (avoid highly leveraged companies)

Return on Equity (ROE) and Return on Capital Employed (ROCE)

Cash Flow from Operations (CFO)

After checking the financial performance, you need to assess the most important factor — valuation.

3. Check the Valuation

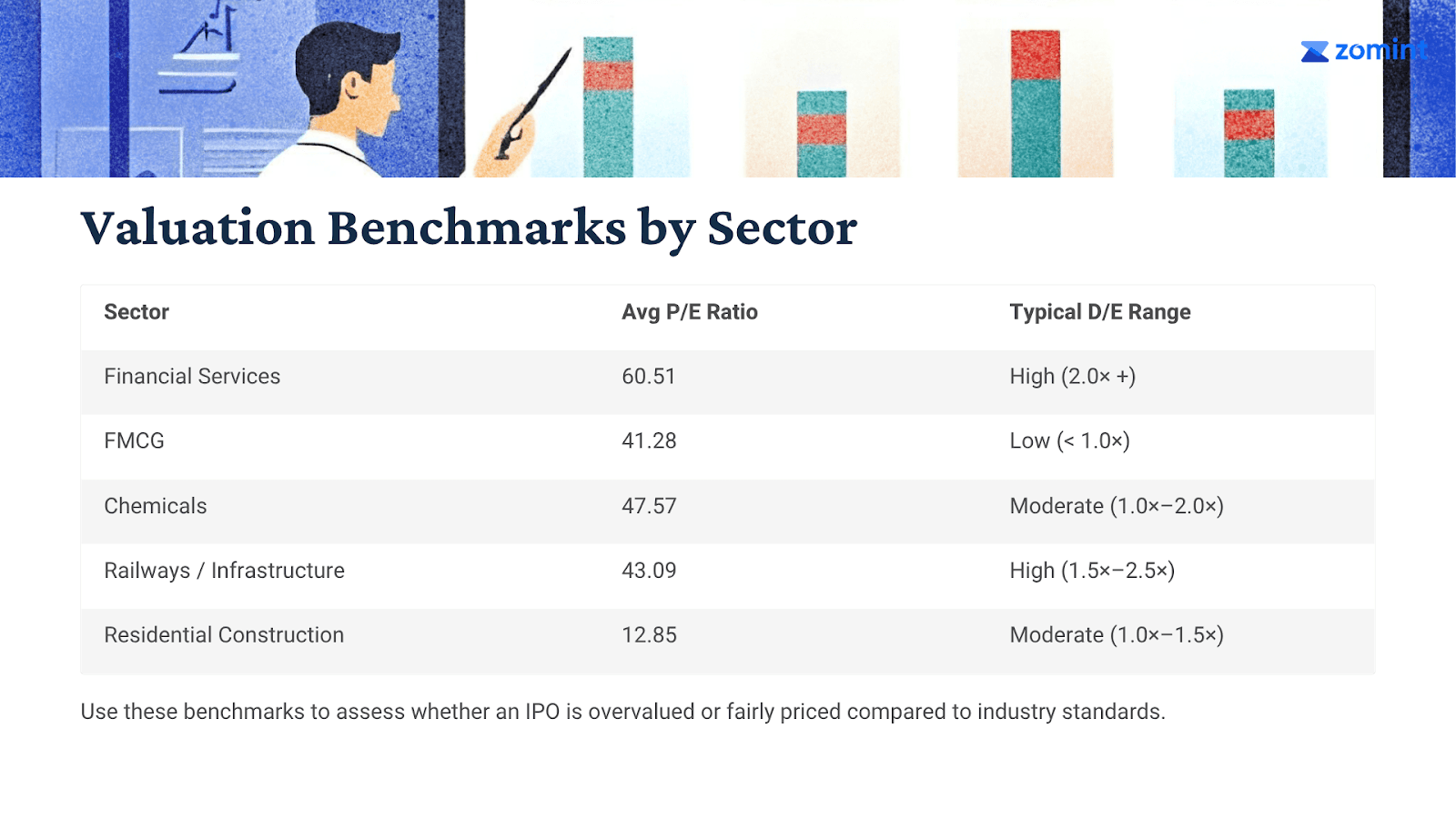

Compare the company's valuation with listed peers in the same industry using: P/E Ratio (Price-to-Earnings), EV/EBITDA, and Price-to-Sales.

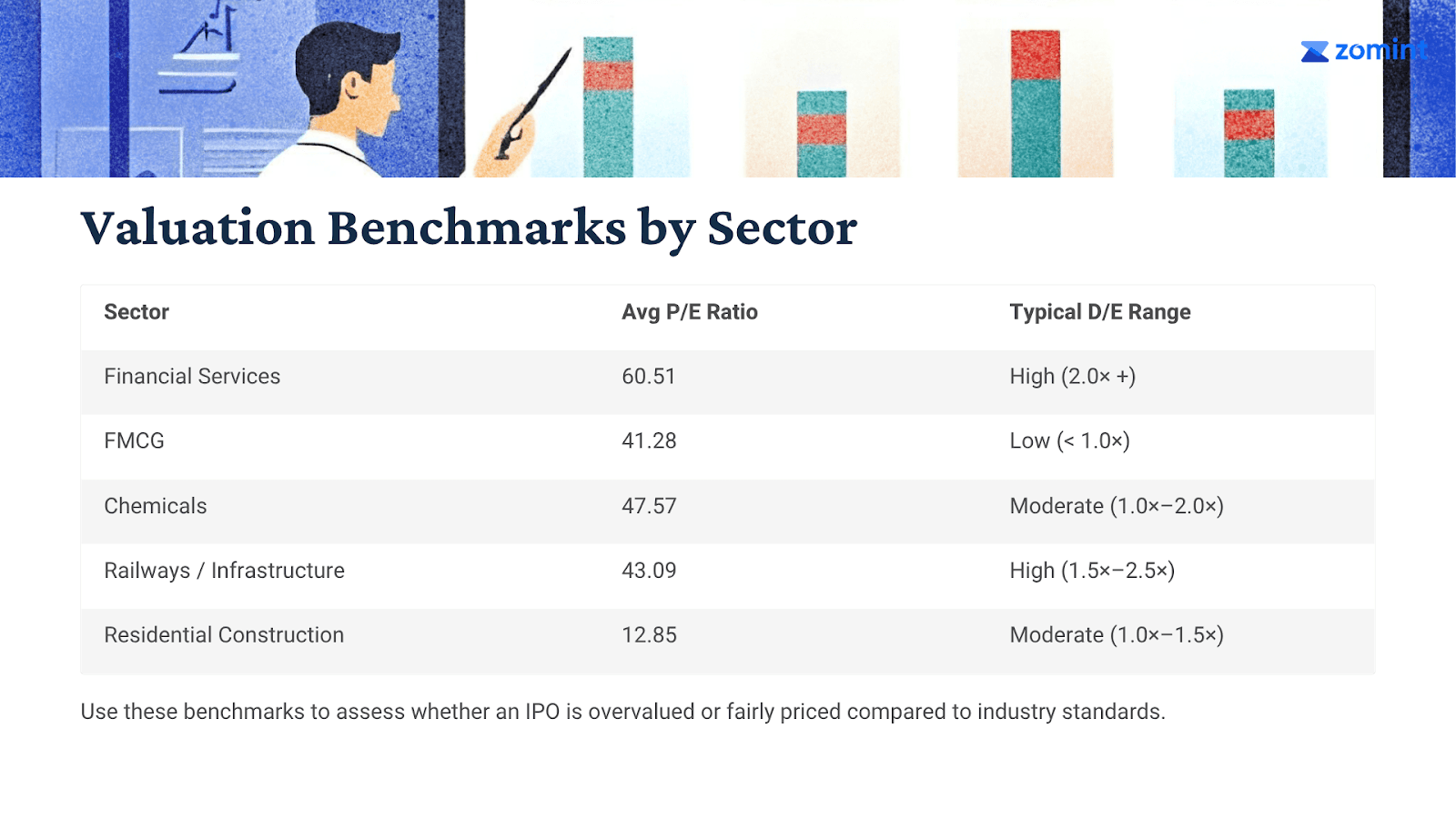

If checking all the data is too complex, just look at the P/E ratio and compare it with that of other companies in the same sector. If P/E ratios are in the 100s and it's not justifiable, it's advisable to approach with caution.

The table below shows the average P/E ratio and debt-to-equity (D/E) for major sectors, which can serve as a benchmark for your valuation check.

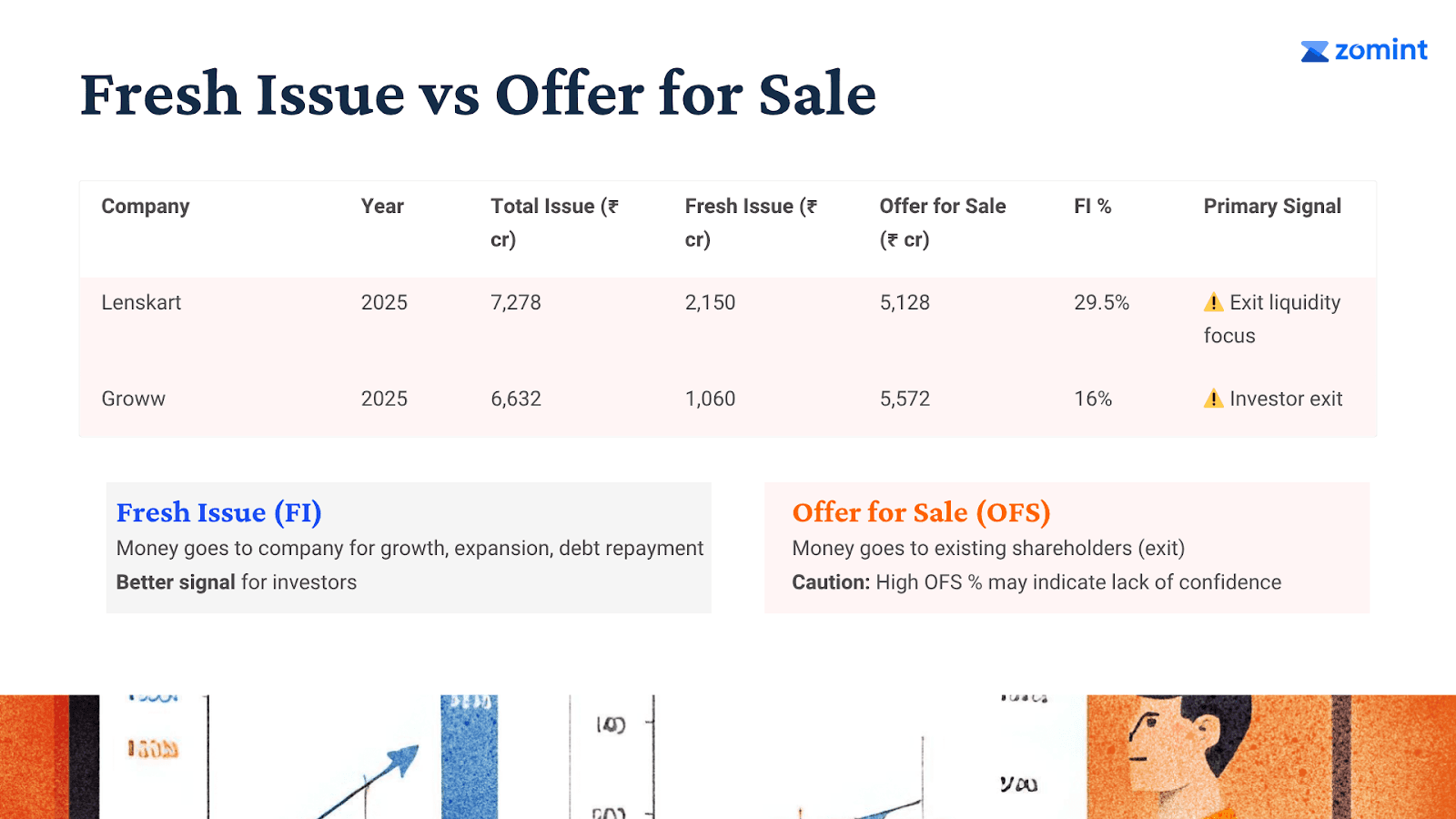

4. Look at the Offer Structure

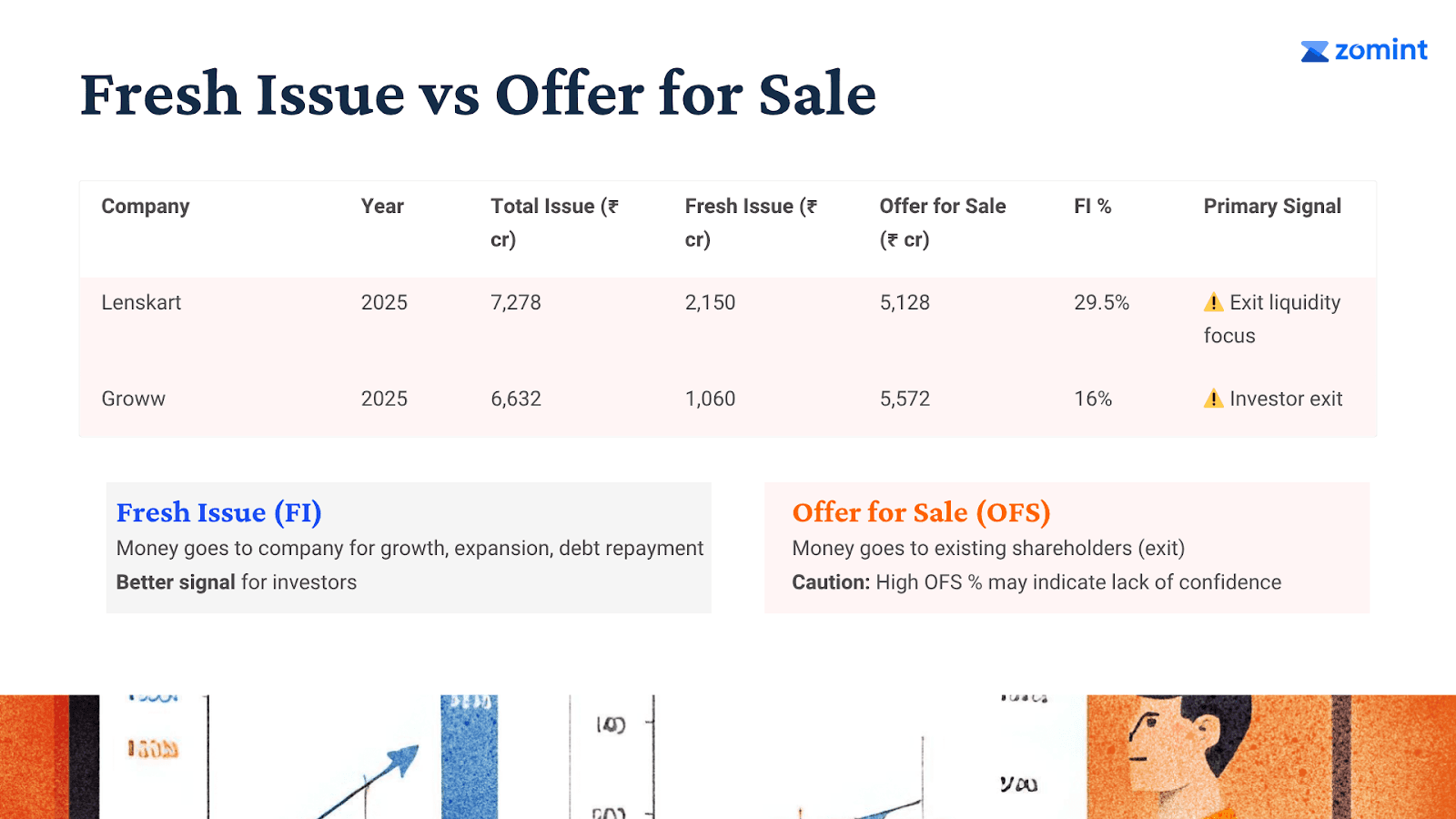

After reviewing the P/E ratio, valuation, financials, and documents, you have one crucial task left: understanding where the money is going.

Fresh Issue (FI): Money goes to the company (good for growth).

Offer for Sale (OFS): Existing investors are selling (watch for promoter exits).

A high OFS share often signals limited growth funding from the IPO itself. Essentially, a company uses an IPO for one of two reasons: to raise money to invest in its growth, or to sell existing shares for profit.

In India, the second case happens frequently, with promoters cashing out and selling shares to investors, often leaving retail investors with losses.

Consider the latest Lenskart IPO, for example. It has a P/E ratio of around 200+. Worryingly, promoters and even CEO Piyush Bansal are selling their shares at whopping valuations, and a significant percentage of the issue is going back to existing investors instead of funding the company’s growth.

This pattern is common. Whenever the primary objective of an IPO is to provide an exit for existing investors and promoters, these issues are almost always extremely overvalued and underdeliver.

Compare that to Bajaj Housing Finance — 100% fresh issue, fully used for business expansion and it has shown that growth in the stock price also.

Now that it’s clear what to check before investing in an IPO, let’s talk about how you can actually invest in one.

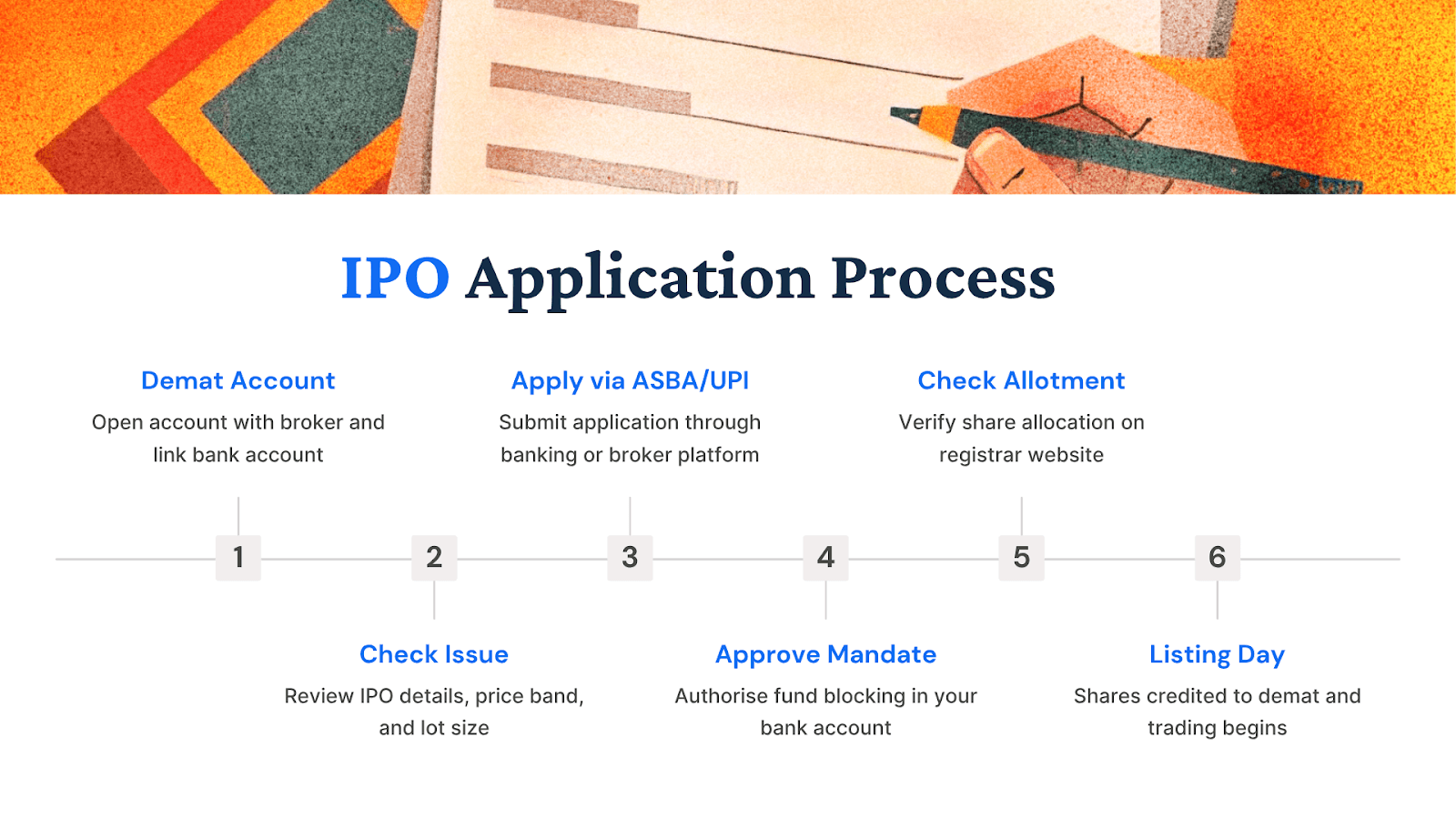

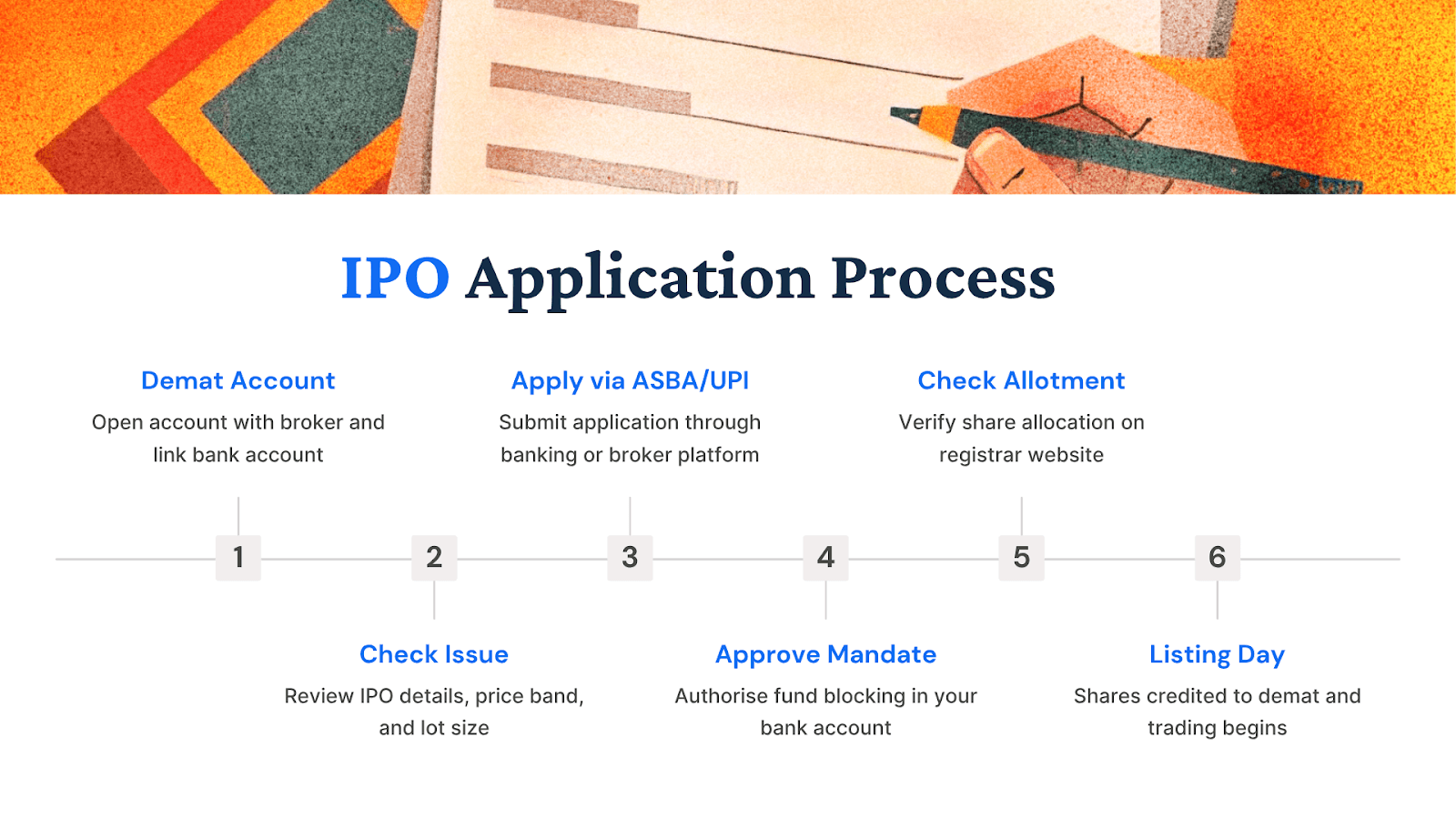

How to Invest in an IPO ?

Open a Demat & Trading Account – Required to apply for and hold IPO shares.

Track Upcoming IPOs – Check NSE/BSE or SEBI for issue dates, price band, and lot size.

Choose Investor Category – Retail (up to ₹2 lakh) or HNI/NII (above ₹2 lakh).

Apply via ASBA or UPI – Use your bank’s net banking or broker apps like Zerodha/Groww.

Approve Payment Mandate – Funds stay blocked until allotment is finalized.

Check Allotment Status – Visit registrar sites like KFinTech or Link Intime after issue closes.

Listing & Trading – Allotted shares appear in your Demat before listing day for trade.

Now that you know what to look for before investing in an IPO, it’s equally important to clear up some common myths and misunderstandings around them. Let’s separate the facts from the noise.

IPO Myths and Realities

Myth | Reality |

"If an IPO is oversubscribed, listing gains are guaranteed." | False. Oversubscription only shows high demand, not profitability. Many highly oversubscribed IPOs still list below the issue price. |

"Big brand names always give strong returns." | Not true. A strong brand does not guarantee a strong business. Hype often leads to poor post-listing performance (e.g., Paytm, Nykaa). |

"IPO investing is a quick way to make money." | Dangerous mindset. IPOs are best suited for long-term investors who believe in the company’s fundamentals, not for short-term trading. |

"The sector is growing, so the IPO will do well." | Misleading. A healthy sector (like EVs or Tech) does not guarantee the individual company will succeed. Sector growth is not equal to company growth. |

"If influencers recommend it, it must be good." | Risky assumption. Influencer opinions are not research. Always check the company's financials, DRHP, and valuations yourself. |

"High valuation means a high-quality company." | Often the opposite. Many highly overvalued IPOs have underperformed. Compare the valuation with sector P/E averages. |

Conclusion: Invest Carefully (or Not)

IPOs can deliver exciting returns—but they also carry high risk. Historical data clearly shows that most new listings fail to reward uninformed investors.

For beginners especially, the default answer should be no—do not rush in blindly. As noted, most retail investors apply due to a friend's suggestion, FOMO, or social media hype. These remain the worst reasons to invest.

Instead, treat every IPO like a regular stock investment. Do your homework. Only invest when you genuinely believe in the company’s long-term growth story and fundamentals, not because of buzz or “listing gain” talk.

Don’t invest in an IPO just because everyone else is. Invest because you understand the company, believe in its story, and are ready to hold it long term.

📢 IPO Season Is Here!

Everyone’s rushing into IPOs again. Lenskart and Groww have already made their debut, while Physics Wallah, boAt, Meesho, and many more companies are now gearing up to hit the market! But here’s the real problem — everyone’s blindly chasing the hype, ignoring the actual financials, and that’s why most investors are losing a lot of money on IPOs.

In fact, 8 out of every 10 IPO underperform, making this more of a new-age pump-and-dump scheme.

You probably remember the Nykaa, Paytm, or Ola Electric IPOs. All three had one thing in common: they were highly oversubscribed yet performed poorly, resulting in huge losses for many investors.

But is this always the case?

Let's again look into some other companies:

LG Electronics India gave a 50% listing gain. Launched at ₹1,140, it is now trading at ₹1,715+.

Bajaj Housing Finance Ltd: Issue price ₹70, listing price ₹150, listing gain 114.29%.

In this case IPOs have yielded amazing returns.

So the crucial question now is: Should we invest in them, and if so, how do we choose the right ones?

This newsletter will answer all these questions. We'll decode the Indian IPO market completely and clear all your doubts so you can invest with full knowledge this IPO season.

What Exactly Is an IPO?

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time, allowing everyday investors to become part-owners of the business.

In simple terms, an IPO is how a company transitions from being privately owned (by founders, promoters, or venture capitalists) to being publicly traded on stock exchanges like the NSE or BSE.

Why Do Companies Go Public?

Companies choose to go public for the following three reasons:

Raise capital for expansion, new projects, or debt repayment.

Provide an exit route for early investors and venture capitalists.

Enhance credibility and visibility in the marketplace.

In recent years, this process has become a huge trend in India. Many people now see IPOs not just as investments, but almost like a chance to win big quickly. With so much social media buzz and heavy oversubscription, India’s IPO market has taken off — raising about $2.8 billion in just the first quarter of 2025.

Because of this massive interest, India now stands among the top countries in the world for IPO activity.

The data below shows that in the first quarter of 2025, India is leading the world in the number of IPOs launched.

With all this hype around IPOs, it’s easy to feel like you’re missing out. But here’s the real question

Should You Invest in IPOs?

The answer to this question is mostly no—at least not blindly.

We don't recommend most retail investors to invest in IPOs because many buy simply because a friend told them to, out of FOMO (Fear of Missing Out), or due to social media hype. These are the worst reasons to buy IPOs.

If you want to invest in IPOs, you have to do proper, deep-down research for each one and then decide whether it makes sense to invest or not.

Let now discuss what you should do before investing in any IPO.

What Should You Do Before Investing in an IPO?

1. Read the DRHP (Draft Red Herring Prospectus)

This is the official document filed with SEBI. It explains everything about the company—business model, financials, risks, and how the IPO money will be used.

Shortcut: Check the summary on SEBI / NSE / BSE or financial portals like Moneycontrol. Reading the DRHP will give you the basic idea of what the IPO is all about.The next step is to check:

2. Analyze Financial Performance

Key ratios to look for:

Revenue growth

EBITDA & Net Profit margins

Debt-to-Equity (avoid highly leveraged companies)

Return on Equity (ROE) and Return on Capital Employed (ROCE)

Cash Flow from Operations (CFO)

After checking the financial performance, you need to assess the most important factor — valuation.

3. Check the Valuation

Compare the company's valuation with listed peers in the same industry using: P/E Ratio (Price-to-Earnings), EV/EBITDA, and Price-to-Sales.

If checking all the data is too complex, just look at the P/E ratio and compare it with that of other companies in the same sector. If P/E ratios are in the 100s and it's not justifiable, it's advisable to approach with caution.

The table below shows the average P/E ratio and debt-to-equity (D/E) for major sectors, which can serve as a benchmark for your valuation check.

4. Look at the Offer Structure

After reviewing the P/E ratio, valuation, financials, and documents, you have one crucial task left: understanding where the money is going.

Fresh Issue (FI): Money goes to the company (good for growth).

Offer for Sale (OFS): Existing investors are selling (watch for promoter exits).

A high OFS share often signals limited growth funding from the IPO itself. Essentially, a company uses an IPO for one of two reasons: to raise money to invest in its growth, or to sell existing shares for profit.

In India, the second case happens frequently, with promoters cashing out and selling shares to investors, often leaving retail investors with losses.

Consider the latest Lenskart IPO, for example. It has a P/E ratio of around 200+. Worryingly, promoters and even CEO Piyush Bansal are selling their shares at whopping valuations, and a significant percentage of the issue is going back to existing investors instead of funding the company’s growth.

This pattern is common. Whenever the primary objective of an IPO is to provide an exit for existing investors and promoters, these issues are almost always extremely overvalued and underdeliver.

Compare that to Bajaj Housing Finance — 100% fresh issue, fully used for business expansion and it has shown that growth in the stock price also.

Now that it’s clear what to check before investing in an IPO, let’s talk about how you can actually invest in one.

How to Invest in an IPO ?

Open a Demat & Trading Account – Required to apply for and hold IPO shares.

Track Upcoming IPOs – Check NSE/BSE or SEBI for issue dates, price band, and lot size.

Choose Investor Category – Retail (up to ₹2 lakh) or HNI/NII (above ₹2 lakh).

Apply via ASBA or UPI – Use your bank’s net banking or broker apps like Zerodha/Groww.

Approve Payment Mandate – Funds stay blocked until allotment is finalized.

Check Allotment Status – Visit registrar sites like KFinTech or Link Intime after issue closes.

Listing & Trading – Allotted shares appear in your Demat before listing day for trade.

Now that you know what to look for before investing in an IPO, it’s equally important to clear up some common myths and misunderstandings around them. Let’s separate the facts from the noise.

IPO Myths and Realities

Myth | Reality |

"If an IPO is oversubscribed, listing gains are guaranteed." | False. Oversubscription only shows high demand, not profitability. Many highly oversubscribed IPOs still list below the issue price. |

"Big brand names always give strong returns." | Not true. A strong brand does not guarantee a strong business. Hype often leads to poor post-listing performance (e.g., Paytm, Nykaa). |

"IPO investing is a quick way to make money." | Dangerous mindset. IPOs are best suited for long-term investors who believe in the company’s fundamentals, not for short-term trading. |

"The sector is growing, so the IPO will do well." | Misleading. A healthy sector (like EVs or Tech) does not guarantee the individual company will succeed. Sector growth is not equal to company growth. |

"If influencers recommend it, it must be good." | Risky assumption. Influencer opinions are not research. Always check the company's financials, DRHP, and valuations yourself. |

"High valuation means a high-quality company." | Often the opposite. Many highly overvalued IPOs have underperformed. Compare the valuation with sector P/E averages. |

Conclusion: Invest Carefully (or Not)

IPOs can deliver exciting returns—but they also carry high risk. Historical data clearly shows that most new listings fail to reward uninformed investors.

For beginners especially, the default answer should be no—do not rush in blindly. As noted, most retail investors apply due to a friend's suggestion, FOMO, or social media hype. These remain the worst reasons to invest.

Instead, treat every IPO like a regular stock investment. Do your homework. Only invest when you genuinely believe in the company’s long-term growth story and fundamentals, not because of buzz or “listing gain” talk.

Don’t invest in an IPO just because everyone else is. Invest because you understand the company, believe in its story, and are ready to hold it long term.