Zomint Blog

Zomint Blog

Zomint Blog

How to Invest in Bonds in 2026 || Earn 10-12% Returns || Fixed Monthly Income

Dec 22, 2025

As we settle into 2026, the RBI has reduced repo rates, and banks have wasted no time slashing FD returns. But that’s only half the problem.

Traditional fixed deposits are no longer delivering the kind of real returns investors need to stay ahead of inflation. A “safe” 6-7% FD offers limited real returns after inflation and taxes, especially in a falling rate environment.

But while the FD window is closing, another door has swung wide open.

Smart investors are increasingly moving capital into an asset class that offers:

Higher yields: Locking in returns of up to 11–12% (risk-dependent)

Predictable income: Regular interest payouts with known cash flows

Rate protection: Ability to lock yields before rates fall further

That asset class is Bonds.

In this newsletter, we break down the bond market from absolute zero to execution—so you can understand where bonds fit in your portfolio in 2026. Let’s dive in.

What Are Bonds? (The Simplest Explanation)

Imagine a company called XYZ Motors.They are selling cars faster than they can make them. To meet demand, they want to build a new factory that costs ₹1,000 Crores. But they don’t have that much cash sitting idle.

XYZ now has two choices:

Option A: Go to a bank. But banks are rigid, demand collateral, and charge high floating interest rates.

Option B: Borrow directly from people like you.

XYZ chooses Option B. Instead of taking one giant loan, they divide that ₹1,000 Crore into small "tickets" of ₹10,000 each.

When you lend them ₹10,000, XYZ gives you a digital certificate called Bond. It is a legal contract where they promise two things:

To pay you a fixed interest (say, 9%) every year.

To return your original ₹10,000 safely at the end of the term.

That’s it. A bond is simply a loan where you are the lender.

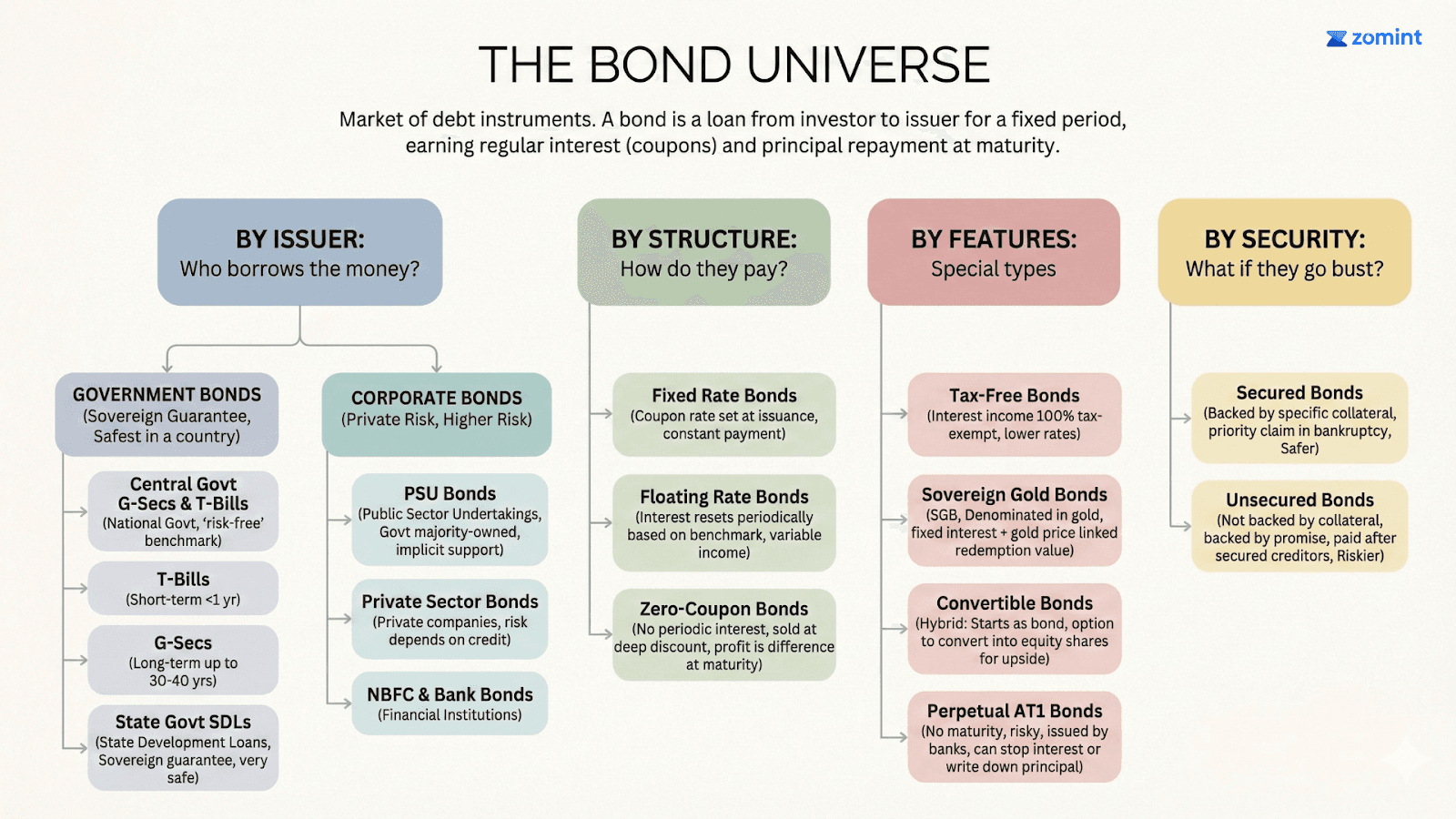

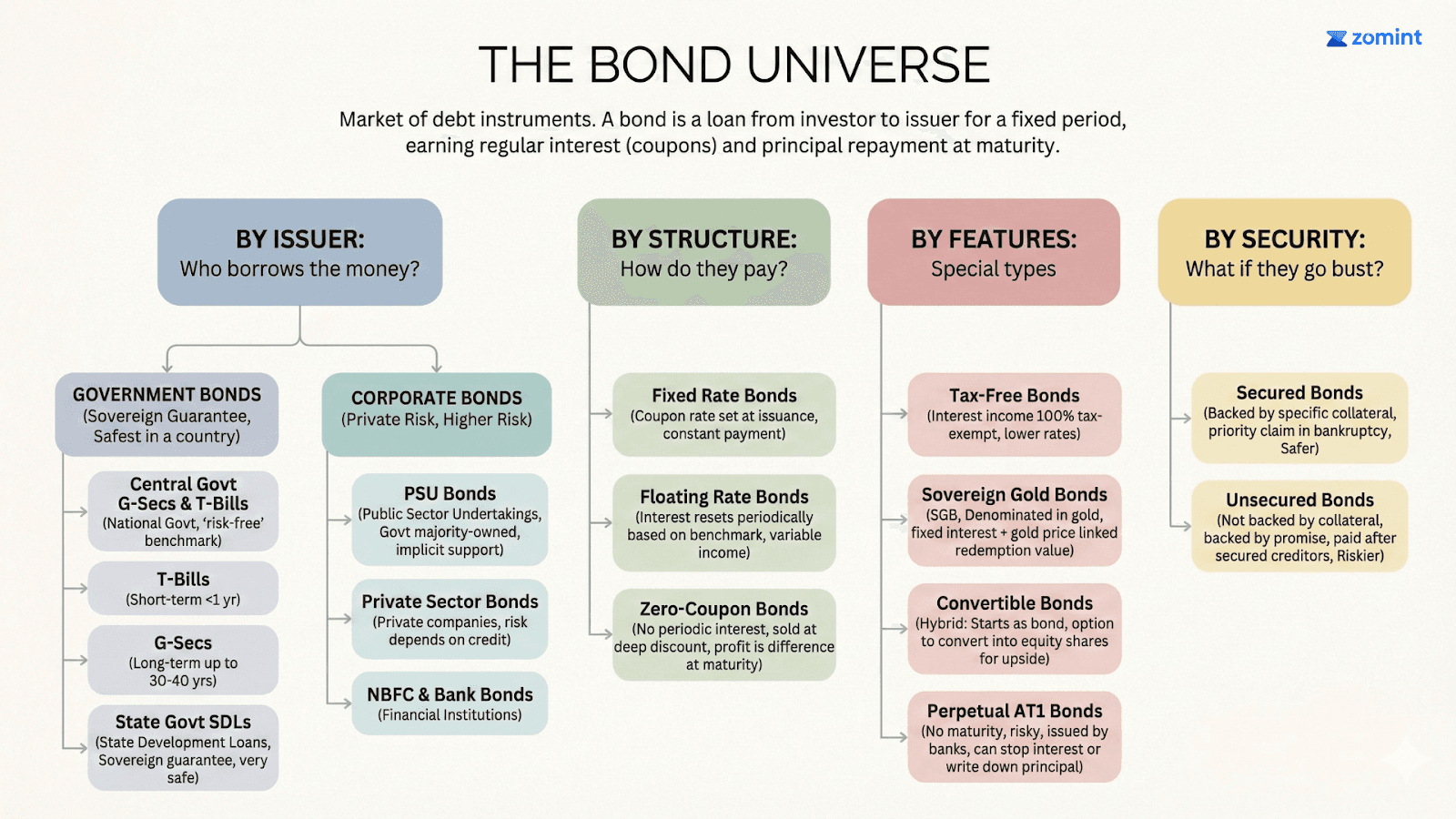

Different Types of Bonds You Can Invest in India?

Think of the Indian bond market like a supermarket with different aisles. Each aisle represents a different type of borrower, offering a distinct balance between safety, return, and income stability.

Government Bonds (G-Secs)

Issuer: Government of India

When you invest in government bonds, you are lending directly to the sovereign.

Backed by a sovereign guarantee

Virtually zero default risk

Expected yields in 2026: ~6.4%–6.8%

Best suited for:

Investors who prioritise capital preservation, stability, and safety over higher returns. These bonds form the lowest-risk layer of a portfolio.

Corporate Bonds

Issuer: Private and public companies such as HDFC, Tata Group companies, and other corporates.

Offer higher returns than government bonds

Carry credit risk, depending on the company’s financial strength and credit rating

Expected yields in 2026: ~7.5%–11%

Best suited for:

Investors seeking regular income and willing to take measured credit risk, especially through high-quality AA or AAA-rated issuers.

PSU Bonds (Public Sector Undertaking Bonds)

Issuer: Government-owned companies such as REC Limited, PFC, and NHAI.

Issued by companies owned or controlled by the Government of India

Considered safer than most private corporate bonds

Typically offer slightly higher returns than G-Secs

Expected yields in 2026: ~7.0%–8.5%

Best suited for:

Conservative investors who want better returns than government bonds while maintaining a high level of safety and predictable income.

What Are the Risks of Investing in Bonds?

Bonds are safer than stocks, but they are not risk-free. You need to watch out for three specific threats.

A. Credit Risk (Will they pay me back?)

In the stock market, you analyze growth. In the bond market, you analyze survival.

Your only job as a bond investor is to answer one question: "Will this company exist in 3 years to pay me back?"

You don't need to guess. Agencies like CRISIL and ICRA investigate these companies and give them a "Report Card" (Credit Rating).

Credit Rating | Expected Yield (2026) | Risk Profile | Type of Issuer (Examples) |

SOVEREIGN | ~6.4% – 6.8% | Zero Risk (Govt Guarantee) | (G-Secs, T-Bills) |

AAA | 7.5% – 8.2% | Extremely Safe (Lowest default risk) | Top-tier PSUs & Corporates |

AA | 8.5% – 9.5% | Very Safe (Slightly higher risk than AAA) | Strong NBFCs & Mid-large Corporates |

A / BBB | 10% – 12% | Moderate/High Risk (High Income Strategy) | Emerging Companies & Microfinance |

Rule: Stick to the AAA or AA bracket. Don’t chase higher yields unless you understand the risk.

B. Interest Rate Risk (The Seesaw Effect)

Bond prices and interest rates move in opposite directions. When rates fall (as they are doing now), existing bond prices rise.

The Opportunity: If you lock in a 9% bond today, and rates drop to 7% next year, your bond becomes "premium property." You can sell it for a profit.

Pro Tip: Coupon vs. Yield (YTM): Most people often look at the Coupon Rate (e.g., 9%). But if you buy a bond on the market at a premium price (say, ₹105 instead of ₹100), your actual return will be lower. Always check the YTM (Yield to Maturity) that is the real number you will earn.

C. Liquidity Risk

Unlike stocks, you can’t always sell a corporate bond instantly. If you need money urgently, you might have to sell at a discount.Liquidity is a risk. If liquidity is important, prefer highly traded bonds, shorter tenors, or debt mutual funds.

Pro Tip: Always invest money you can keep until maturity to get the most benefits.

How Much of Your Portfolio Should Be in Bonds?

To understand asset allocation, think of your portfolio as a high-performance vehicle. Each component serves a critical engineering function:

Equity (The Engine): Designed for power and speed. This is your growth engine, driving long-term wealth accumulation and beating inflation.

Bonds (The Shock Absorbers): Designed to dampen volatility. When the "road" (the market) gets bumpy, bonds absorb the impact, ensuring the journey remains smooth.

Age Group | Equity % (Stocks) | Bond % (Stability) | Why This Mix? |

20s – 30s | 80% – 90% | 10% – 20% | Growth Phase: You have decades to recover if the stock market crashes. Bonds are just a small safety net here. |

40s – 50s | 60% – 70% | 30% – 40% | Balance Phase: You have major expenses coming up (home, kids). You need growth, but you can't afford to lose 50% of your capital. |

60s + | 30% – 40% | 60% – 70% | Income Phase: You stop working, so your money must work for you. Bonds provide the "salary" to pay monthly bills. |

The Strategy: You invest in bonds so that one bad year in the stock market doesn’t destroy your lifestyle. If stocks crash 20%, your bond income keeps hitting your bank account, preventing panic.

After basic understanding of Bonds, A common question is: "Why should I pick individual bonds when I can just buy a Debt Mutual Fund?"

Bond Mutual Funds vs. Individual Bonds Comparison

Debt Mutual Funds pool money from thousands of investors to buy a basket of bonds. They offer convenience, but in 2026, they come with a significant disadvantage for high-income earners.

Here is the breakdown of why one might be "Better" or "Worse" for you.

The Comparison Table

Feature | Bond Mutual Funds (Debt Funds) | Individual Bonds (Direct Ownership) |

Diversification | Better. One fund holds 50+ bonds. If one company defaults, your impact is minimal. | Worse. You are concentrated. If you buy only one bond and the issuer defaults, you lose capital. |

Liquidity | Better. You can sell your units any day (T+1 settlement). | Worse. Corporate bonds can be illiquid. You might not find a buyer instantly if you need to sell early. |

Returns | Unpredictable. The NAV fluctuates daily based on interest rates. You never know exactly what you will earn. | Fixed. You know exactly how much interest you will get and exactly when your principal comes back. |

Taxation | All gains taxed at slab rate, regardless of holding period | Interest income → slab tax |

Costs | Expense Ratio: You pay ~0.5% to 1.5% annually to the fund manager. | Zero: No annual fees. You just pay a one-time brokerage when buying. |

The Verdict: Which One Wins?

Choose Mutual Funds If:

You are a Beginner: You have small capital (e.g., ₹5,000 SIP) and don't know how to analyze credit ratings.

You Need Liquidity: You might need the money back in 3 months.

You want Safety First: You prefer the safety of a diversified basket over higher returns.

Choose Individual Bonds If:

You are in the 30% Tax Bracket: Potential tax efficiency on capital gains (12.5% LTCG if sold after 12 months).

You Want a "Salary": You need predictable monthly cash flow hitting your bank account (Mutual funds accumulate; they don't typically pay out monthly cash reliably).

You Can Hold to Maturity: You treat this money as "locked" for 2-3 years.

Now that you understand the difference between direct bonds and bond mutual funds, let’s look at how you can actually invest in bonds.

How to Invest in Bonds?

Path 1: RBI Retail Direct

Best For: Buying Government Bonds directly.

Pros: Zero fees. 100% Sovereign Guarantee.Best for buying Govt bonds.

Cons: Complex interface; no corporate bonds available.

Path 2: Your stock brokers

You can also invest in bonds through your regular stock-broking apps. However, in this route, you are responsible for your own research.

If you prefer a hassle-free way to invest in bonds, and want clarity on which bonds suit your financial goals, Zomint is here to help.

At Zomint, we curate institutional-grade bonds, continuously monitor issuer credit health, and ensure proper diversification. It’s like having a professional fund manager for your fixed-income investments, without the complexity.

If you’d like to explore bond investing with guidance, you can book a free call with us or speak directly with your Relationship Manager to get started.

How You Get Paid After Buying Bonds? | Fixed Monthly Income From Bond

Let’s look at the cash flow of a ₹1 Lakh investment in a monthly payout bond.

Component | Value |

Investment Amount | ₹1,00,000 |

Interest Rate | 9% p.a. |

Annual Interest | ₹9,000 |

Monthly Payout (Gross) | ₹750 |

Every month, ₹750 hits your bank account as interest, and at the end of the maturity period, your entire principal amount is returned to you.

Taxation in Bonds

Before you count your returns, you must account for the taxman.

Interest Income: This is added to your total income and taxed at your Income Tax Slab Rate. (Same as FDs).

Capital Gains: If you sell a listed bond after 12 months, the profit is taxed at 12.5% (Long Term Capital Gains). This is a significant advantage over FDs for those in higher tax brackets as for FDs taxes on interest are similar to the tax bracket of the investor.

This concludes our deep dive into the bond market. We hope this guide has cleared the confusion and left you with a solid plan for investing in bonds in 2026.

Should You Invest in Bonds in 2026? Realistic Return Expectations

So, what should you realistically aim for from bonds in 2026?

Bond Category | Expected Returns (2026) | Risk Profile | Best Suited For |

Government Bonds (G-Secs) | ~6.5% | Very Low (Sovereign-backed) | Investors focused on capital preservation, stability, and safety |

AAA Corporate Bonds | ~7.5% – 8.2% | Low (High credit quality) | Investors seeking better-than-FD returns with controlled risk |

A / BBB Corporate Bonds | ~9% – 11% | Moderate to High | Investors targeting higher income and willing to accept measured credit risk |

With inflation expected to hover around 4%–5%, a well-structured bond allocation can still deliver a real return of ~4%, outperforming most traditional savings options after inflation.

Smart investing today isn’t about chasing the highest possible return. It’s about securing predictable income, protecting capital during volatile markets, and reducing dependence on falling FD rates.

Bonds may feel boring. They don’t make headlines or spark excitement.But in uncertain markets, boring is powerful.

Your Next Move: Check your portfolio today. If you are sitting on idle cash and want to lock in a higher yield, bonds are one of the ways to go.

Still unsure where to start? Book a Free Call with our Wealth Experts, and let us plan and manage your entire portfolio for you.

Disclaimer:

This content is for educational purposes only and does not constitute investment advice or a recommendation. Returns and yields are indicative and depend on market conditions, credit risk, and holding period. Please consult a qualified financial advisor before investing.

As we settle into 2026, the RBI has reduced repo rates, and banks have wasted no time slashing FD returns. But that’s only half the problem.

Traditional fixed deposits are no longer delivering the kind of real returns investors need to stay ahead of inflation. A “safe” 6-7% FD offers limited real returns after inflation and taxes, especially in a falling rate environment.

But while the FD window is closing, another door has swung wide open.

Smart investors are increasingly moving capital into an asset class that offers:

Higher yields: Locking in returns of up to 11–12% (risk-dependent)

Predictable income: Regular interest payouts with known cash flows

Rate protection: Ability to lock yields before rates fall further

That asset class is Bonds.

In this newsletter, we break down the bond market from absolute zero to execution—so you can understand where bonds fit in your portfolio in 2026. Let’s dive in.

What Are Bonds? (The Simplest Explanation)

Imagine a company called XYZ Motors.They are selling cars faster than they can make them. To meet demand, they want to build a new factory that costs ₹1,000 Crores. But they don’t have that much cash sitting idle.

XYZ now has two choices:

Option A: Go to a bank. But banks are rigid, demand collateral, and charge high floating interest rates.

Option B: Borrow directly from people like you.

XYZ chooses Option B. Instead of taking one giant loan, they divide that ₹1,000 Crore into small "tickets" of ₹10,000 each.

When you lend them ₹10,000, XYZ gives you a digital certificate called Bond. It is a legal contract where they promise two things:

To pay you a fixed interest (say, 9%) every year.

To return your original ₹10,000 safely at the end of the term.

That’s it. A bond is simply a loan where you are the lender.

Different Types of Bonds You Can Invest in India?

Think of the Indian bond market like a supermarket with different aisles. Each aisle represents a different type of borrower, offering a distinct balance between safety, return, and income stability.

Government Bonds (G-Secs)

Issuer: Government of India

When you invest in government bonds, you are lending directly to the sovereign.

Backed by a sovereign guarantee

Virtually zero default risk

Expected yields in 2026: ~6.4%–6.8%

Best suited for:

Investors who prioritise capital preservation, stability, and safety over higher returns. These bonds form the lowest-risk layer of a portfolio.

Corporate Bonds

Issuer: Private and public companies such as HDFC, Tata Group companies, and other corporates.

Offer higher returns than government bonds

Carry credit risk, depending on the company’s financial strength and credit rating

Expected yields in 2026: ~7.5%–11%

Best suited for:

Investors seeking regular income and willing to take measured credit risk, especially through high-quality AA or AAA-rated issuers.

PSU Bonds (Public Sector Undertaking Bonds)

Issuer: Government-owned companies such as REC Limited, PFC, and NHAI.

Issued by companies owned or controlled by the Government of India

Considered safer than most private corporate bonds

Typically offer slightly higher returns than G-Secs

Expected yields in 2026: ~7.0%–8.5%

Best suited for:

Conservative investors who want better returns than government bonds while maintaining a high level of safety and predictable income.

What Are the Risks of Investing in Bonds?

Bonds are safer than stocks, but they are not risk-free. You need to watch out for three specific threats.

A. Credit Risk (Will they pay me back?)

In the stock market, you analyze growth. In the bond market, you analyze survival.

Your only job as a bond investor is to answer one question: "Will this company exist in 3 years to pay me back?"

You don't need to guess. Agencies like CRISIL and ICRA investigate these companies and give them a "Report Card" (Credit Rating).

Credit Rating | Expected Yield (2026) | Risk Profile | Type of Issuer (Examples) |

SOVEREIGN | ~6.4% – 6.8% | Zero Risk (Govt Guarantee) | (G-Secs, T-Bills) |

AAA | 7.5% – 8.2% | Extremely Safe (Lowest default risk) | Top-tier PSUs & Corporates |

AA | 8.5% – 9.5% | Very Safe (Slightly higher risk than AAA) | Strong NBFCs & Mid-large Corporates |

A / BBB | 10% – 12% | Moderate/High Risk (High Income Strategy) | Emerging Companies & Microfinance |

Rule: Stick to the AAA or AA bracket. Don’t chase higher yields unless you understand the risk.

B. Interest Rate Risk (The Seesaw Effect)

Bond prices and interest rates move in opposite directions. When rates fall (as they are doing now), existing bond prices rise.

The Opportunity: If you lock in a 9% bond today, and rates drop to 7% next year, your bond becomes "premium property." You can sell it for a profit.

Pro Tip: Coupon vs. Yield (YTM): Most people often look at the Coupon Rate (e.g., 9%). But if you buy a bond on the market at a premium price (say, ₹105 instead of ₹100), your actual return will be lower. Always check the YTM (Yield to Maturity) that is the real number you will earn.

C. Liquidity Risk

Unlike stocks, you can’t always sell a corporate bond instantly. If you need money urgently, you might have to sell at a discount.Liquidity is a risk. If liquidity is important, prefer highly traded bonds, shorter tenors, or debt mutual funds.

Pro Tip: Always invest money you can keep until maturity to get the most benefits.

How Much of Your Portfolio Should Be in Bonds?

To understand asset allocation, think of your portfolio as a high-performance vehicle. Each component serves a critical engineering function:

Equity (The Engine): Designed for power and speed. This is your growth engine, driving long-term wealth accumulation and beating inflation.

Bonds (The Shock Absorbers): Designed to dampen volatility. When the "road" (the market) gets bumpy, bonds absorb the impact, ensuring the journey remains smooth.

Age Group | Equity % (Stocks) | Bond % (Stability) | Why This Mix? |

20s – 30s | 80% – 90% | 10% – 20% | Growth Phase: You have decades to recover if the stock market crashes. Bonds are just a small safety net here. |

40s – 50s | 60% – 70% | 30% – 40% | Balance Phase: You have major expenses coming up (home, kids). You need growth, but you can't afford to lose 50% of your capital. |

60s + | 30% – 40% | 60% – 70% | Income Phase: You stop working, so your money must work for you. Bonds provide the "salary" to pay monthly bills. |

The Strategy: You invest in bonds so that one bad year in the stock market doesn’t destroy your lifestyle. If stocks crash 20%, your bond income keeps hitting your bank account, preventing panic.

After basic understanding of Bonds, A common question is: "Why should I pick individual bonds when I can just buy a Debt Mutual Fund?"

Bond Mutual Funds vs. Individual Bonds Comparison

Debt Mutual Funds pool money from thousands of investors to buy a basket of bonds. They offer convenience, but in 2026, they come with a significant disadvantage for high-income earners.

Here is the breakdown of why one might be "Better" or "Worse" for you.

The Comparison Table

Feature | Bond Mutual Funds (Debt Funds) | Individual Bonds (Direct Ownership) |

Diversification | Better. One fund holds 50+ bonds. If one company defaults, your impact is minimal. | Worse. You are concentrated. If you buy only one bond and the issuer defaults, you lose capital. |

Liquidity | Better. You can sell your units any day (T+1 settlement). | Worse. Corporate bonds can be illiquid. You might not find a buyer instantly if you need to sell early. |

Returns | Unpredictable. The NAV fluctuates daily based on interest rates. You never know exactly what you will earn. | Fixed. You know exactly how much interest you will get and exactly when your principal comes back. |

Taxation | All gains taxed at slab rate, regardless of holding period | Interest income → slab tax |

Costs | Expense Ratio: You pay ~0.5% to 1.5% annually to the fund manager. | Zero: No annual fees. You just pay a one-time brokerage when buying. |

The Verdict: Which One Wins?

Choose Mutual Funds If:

You are a Beginner: You have small capital (e.g., ₹5,000 SIP) and don't know how to analyze credit ratings.

You Need Liquidity: You might need the money back in 3 months.

You want Safety First: You prefer the safety of a diversified basket over higher returns.

Choose Individual Bonds If:

You are in the 30% Tax Bracket: Potential tax efficiency on capital gains (12.5% LTCG if sold after 12 months).

You Want a "Salary": You need predictable monthly cash flow hitting your bank account (Mutual funds accumulate; they don't typically pay out monthly cash reliably).

You Can Hold to Maturity: You treat this money as "locked" for 2-3 years.

Now that you understand the difference between direct bonds and bond mutual funds, let’s look at how you can actually invest in bonds.

How to Invest in Bonds?

Path 1: RBI Retail Direct

Best For: Buying Government Bonds directly.

Pros: Zero fees. 100% Sovereign Guarantee.Best for buying Govt bonds.

Cons: Complex interface; no corporate bonds available.

Path 2: Your stock brokers

You can also invest in bonds through your regular stock-broking apps. However, in this route, you are responsible for your own research.

If you prefer a hassle-free way to invest in bonds, and want clarity on which bonds suit your financial goals, Zomint is here to help.

At Zomint, we curate institutional-grade bonds, continuously monitor issuer credit health, and ensure proper diversification. It’s like having a professional fund manager for your fixed-income investments, without the complexity.

If you’d like to explore bond investing with guidance, you can book a free call with us or speak directly with your Relationship Manager to get started.

How You Get Paid After Buying Bonds? | Fixed Monthly Income From Bond

Let’s look at the cash flow of a ₹1 Lakh investment in a monthly payout bond.

Component | Value |

Investment Amount | ₹1,00,000 |

Interest Rate | 9% p.a. |

Annual Interest | ₹9,000 |

Monthly Payout (Gross) | ₹750 |

Every month, ₹750 hits your bank account as interest, and at the end of the maturity period, your entire principal amount is returned to you.

Taxation in Bonds

Before you count your returns, you must account for the taxman.

Interest Income: This is added to your total income and taxed at your Income Tax Slab Rate. (Same as FDs).

Capital Gains: If you sell a listed bond after 12 months, the profit is taxed at 12.5% (Long Term Capital Gains). This is a significant advantage over FDs for those in higher tax brackets as for FDs taxes on interest are similar to the tax bracket of the investor.

This concludes our deep dive into the bond market. We hope this guide has cleared the confusion and left you with a solid plan for investing in bonds in 2026.

Should You Invest in Bonds in 2026? Realistic Return Expectations

So, what should you realistically aim for from bonds in 2026?

Bond Category | Expected Returns (2026) | Risk Profile | Best Suited For |

Government Bonds (G-Secs) | ~6.5% | Very Low (Sovereign-backed) | Investors focused on capital preservation, stability, and safety |

AAA Corporate Bonds | ~7.5% – 8.2% | Low (High credit quality) | Investors seeking better-than-FD returns with controlled risk |

A / BBB Corporate Bonds | ~9% – 11% | Moderate to High | Investors targeting higher income and willing to accept measured credit risk |

With inflation expected to hover around 4%–5%, a well-structured bond allocation can still deliver a real return of ~4%, outperforming most traditional savings options after inflation.

Smart investing today isn’t about chasing the highest possible return. It’s about securing predictable income, protecting capital during volatile markets, and reducing dependence on falling FD rates.

Bonds may feel boring. They don’t make headlines or spark excitement.But in uncertain markets, boring is powerful.

Your Next Move: Check your portfolio today. If you are sitting on idle cash and want to lock in a higher yield, bonds are one of the ways to go.

Still unsure where to start? Book a Free Call with our Wealth Experts, and let us plan and manage your entire portfolio for you.

Disclaimer:

This content is for educational purposes only and does not constitute investment advice or a recommendation. Returns and yields are indicative and depend on market conditions, credit risk, and holding period. Please consult a qualified financial advisor before investing.