Zomint Blog

Zomint Blog

Zomint Blog

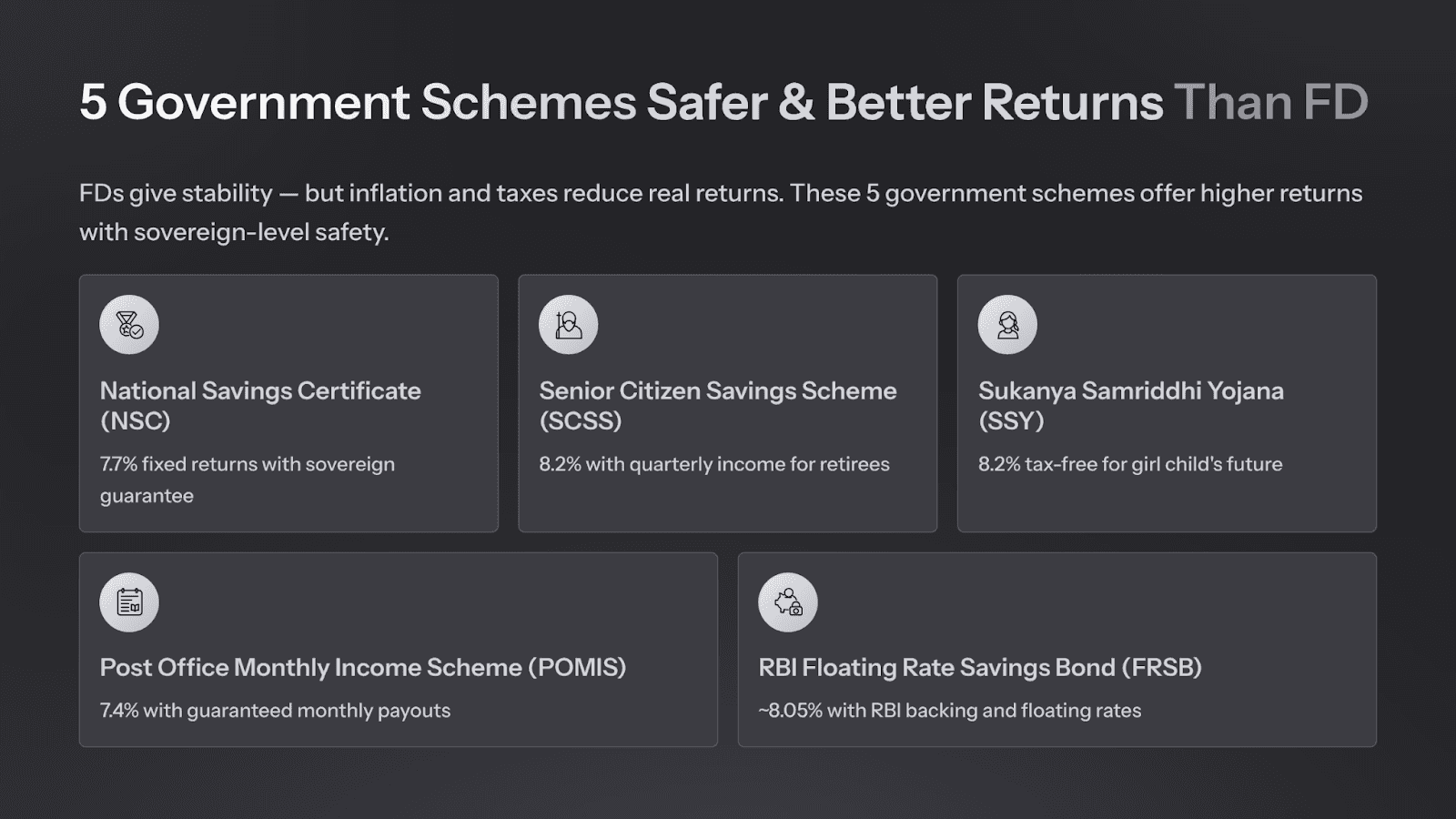

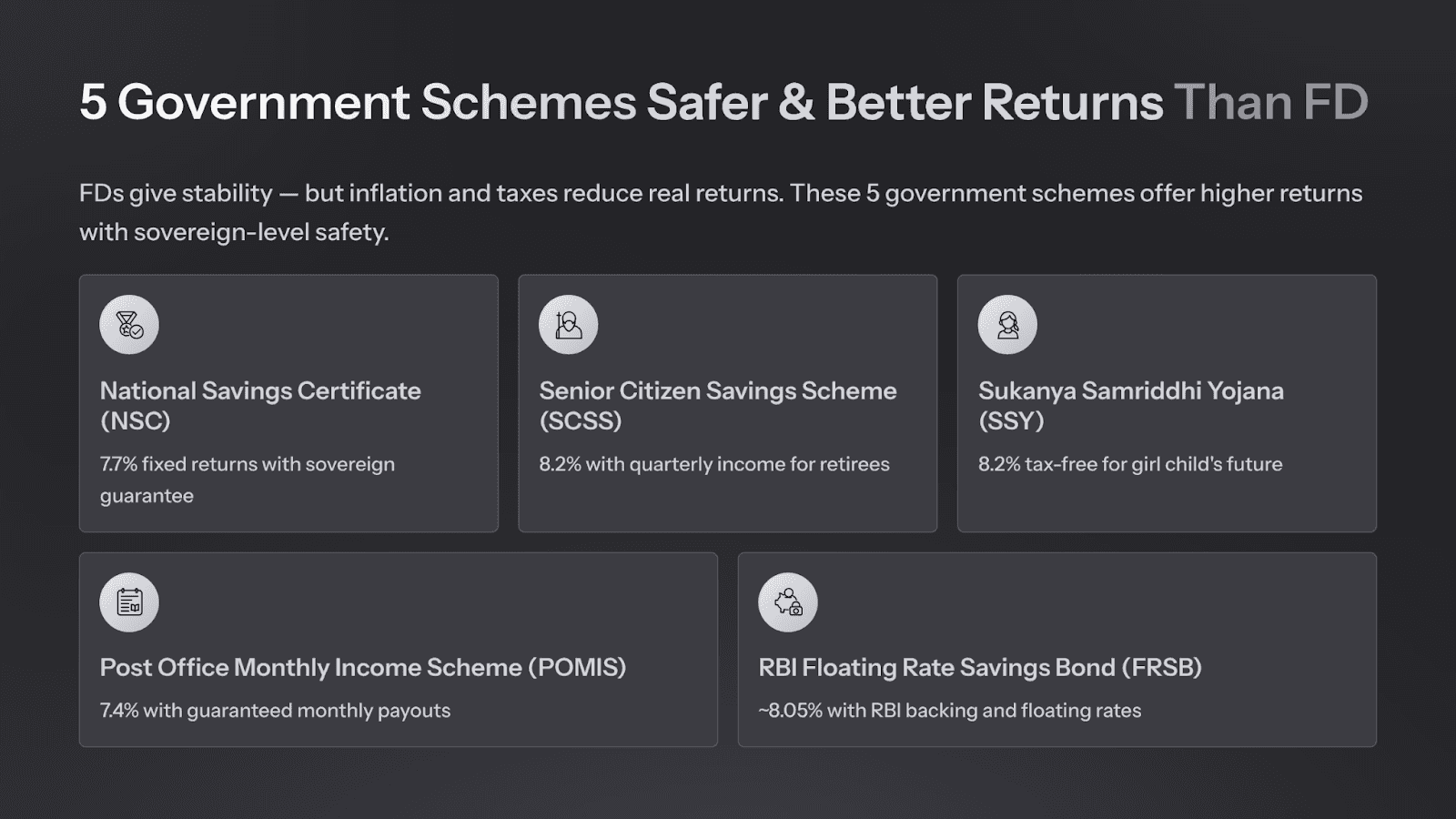

5 Schemes Safer & Better Returns Than FD

Nov 24, 2025

Most Indians trust bank Fixed Deposits (FDs) for one simple reason — Guaranteed returns.

But here’s the hidden truth:

The rise in daily living costs (inflation) and the tax you pay on FD interest can quietly eat away your returns.

For example, a 6% FD doesn’t actually give you 6% in hand.After tax (say 30%), your effective return falls to ~4.2%.

If you compare this with inflation at ~5%, you are actually losing money by keeping your savings in an FD.

Now, regarding safety, your money is not even entirely safe.Your bank deposits are insured only up to ₹5 lakh per bank (principal + interest) by the DICGC. That means if you have an FD of 1 crore rupees and your bank collapses, you will only receive 5 lakhs.

The Good News?

There are several government-backed saving schemes that often pay higher interest than FDs while offering equal or even higher safety.

In this newsletter, we will break down 5 such schemes.

5 Government Schemes That Are Safer Than FDs and Give Better Returns

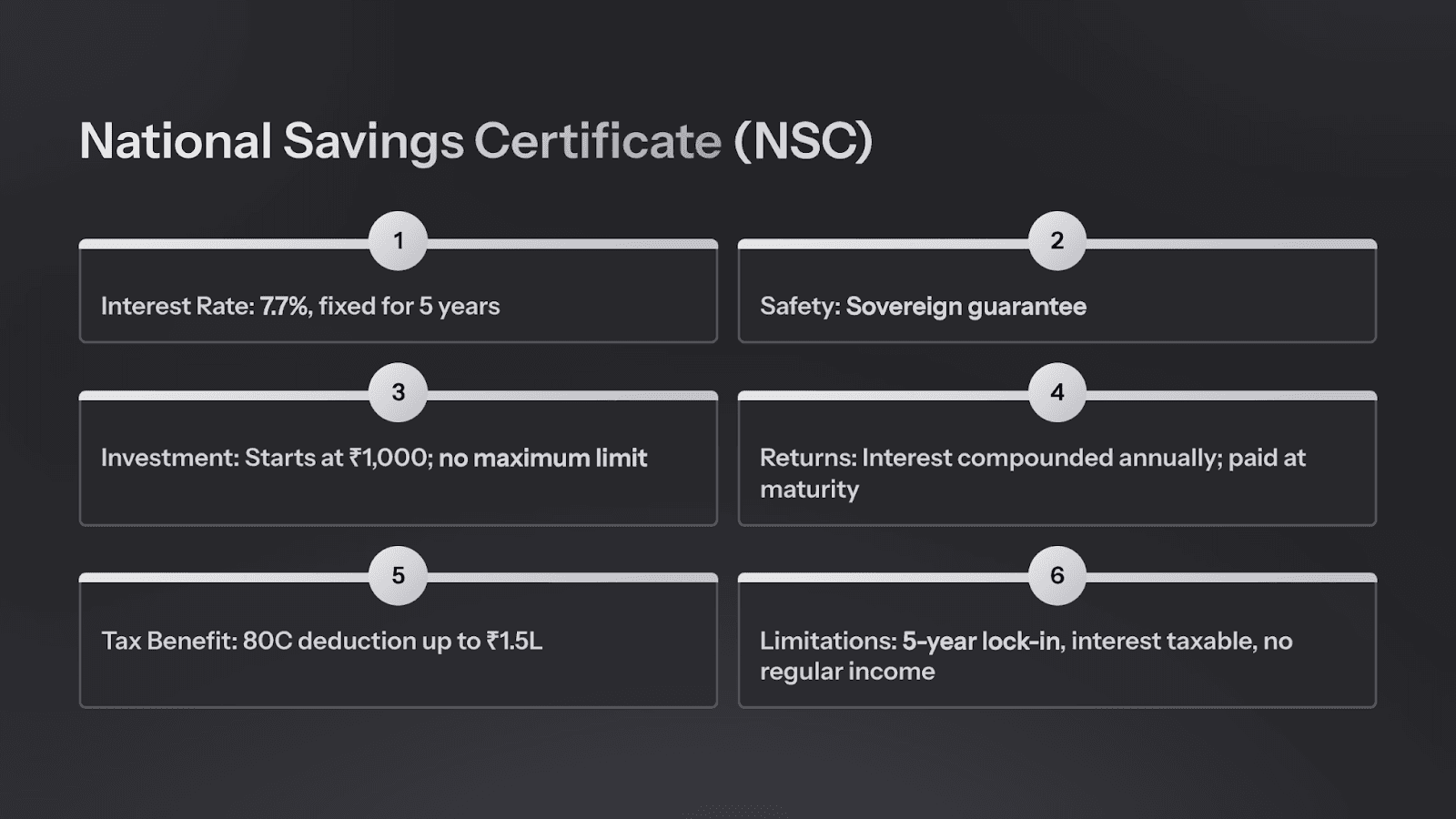

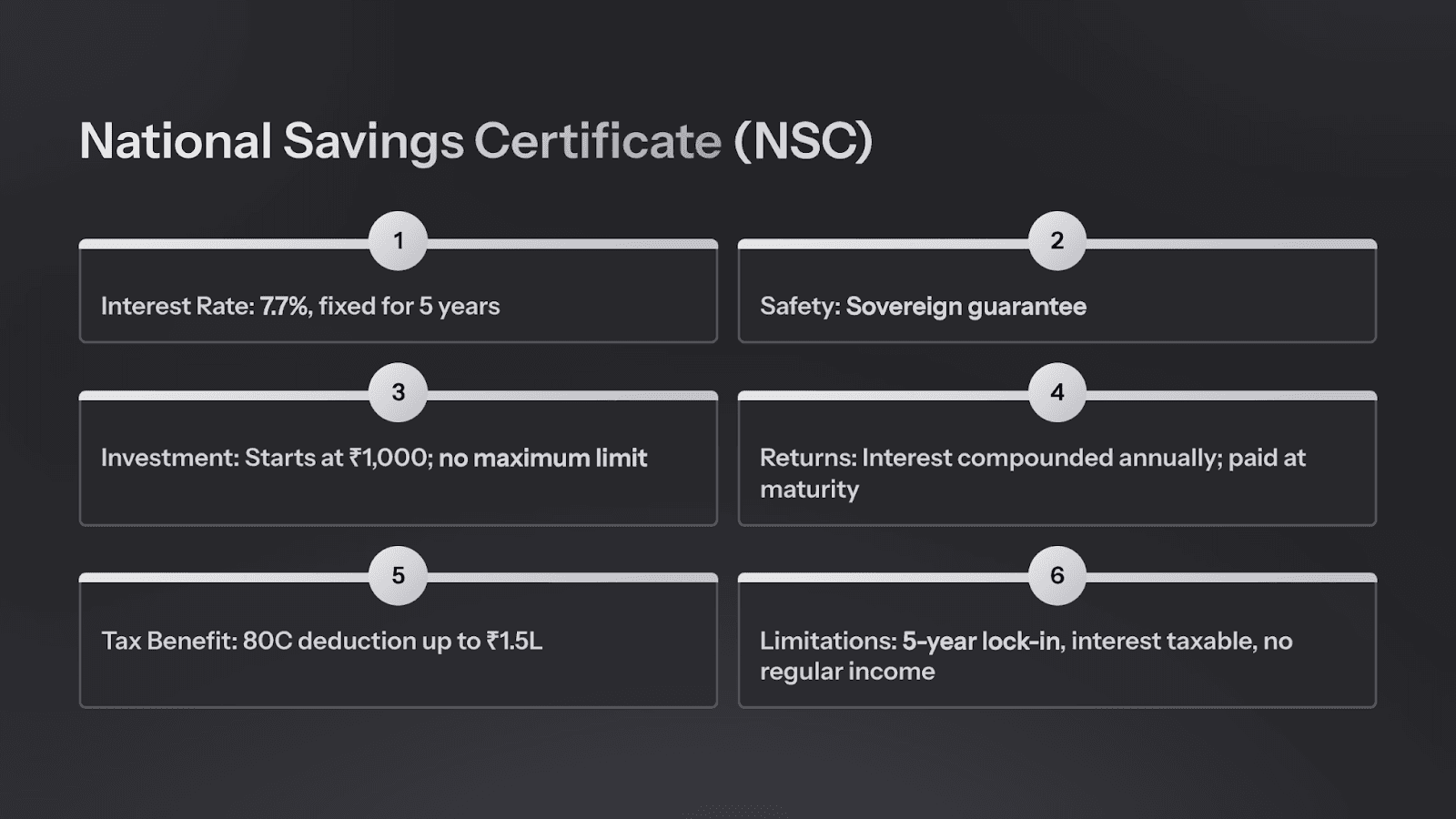

1. National Savings Certificate (NSC)

The National Savings Certificate (NSC) is one of the simplest and most trusted small-savings schemes in India. It is available across all Post Offices in the country.

You can start an NSC with as little as ₹1,000, and there is no upper limit on how much you can invest.

The account can be opened individually or jointly, which gives families flexibility.

Another useful feature is that banks often accept NSC certificates as collateral, allowing you to take a loan against them.

The principal amount invested in NSC qualifies for a Section 80C tax deduction of up to ₹1.5 lakh in a financial year.However, the interest earned is taxable on maturity.

Interest Rate & Tenure

Current Rate: 7.7% per annum, fixed for the full 5-year tenure.

The interest is compounded annually but paid out only at maturity.

Cons / Limitations

5-year lock-in: No premature closure except in rare cases (e.g., death of the holder).

Taxable Interest: Though the principal qualifies for 80C, the interest does not.

No regular income: Full payout happens only at maturity.

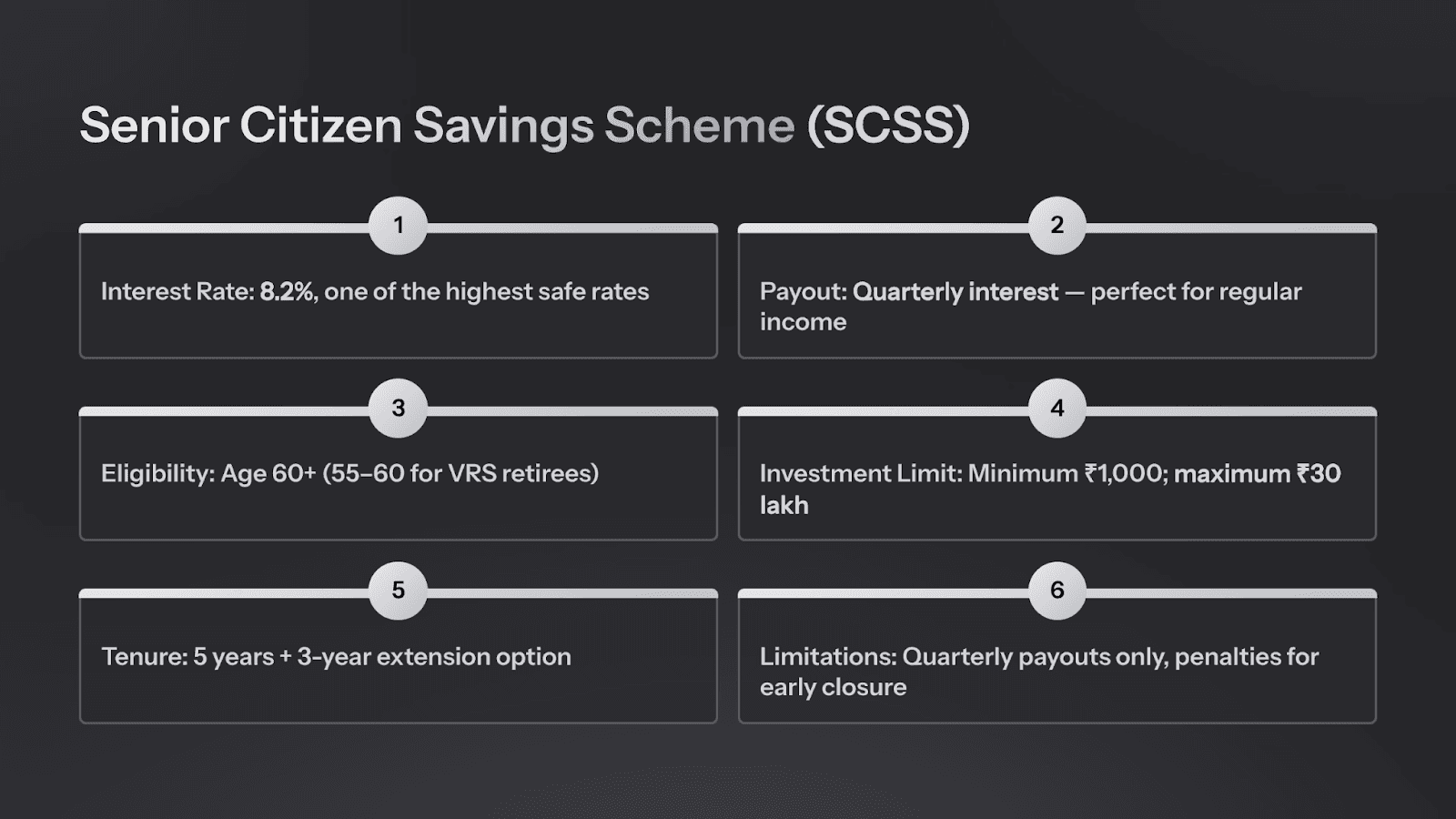

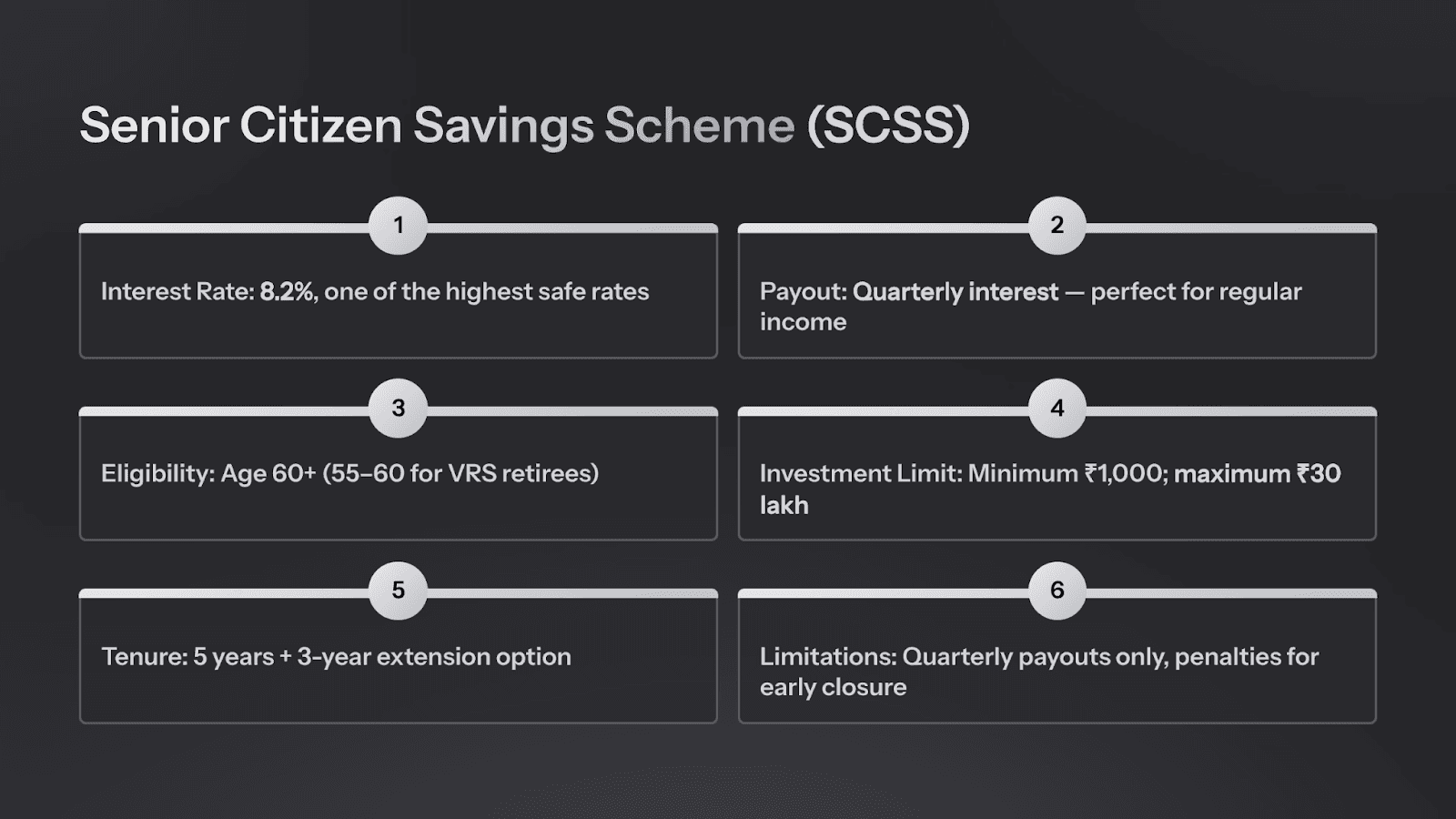

2. Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme (SCSS) is one of the highest and safest income options available for retirees in India. It is designed specifically for senior citizens, which is why the government offers such an attractive interest rate.

Anyone aged 60 and above can open an SCSS account. Individuals aged 55 to 60 who have retired early can also apply.

The account can be opened individually or jointly, although joint accounts are allowed only with a spouse.

Investors can start with as little as ₹1,000, and the maximum combined deposit limit across all SCSS accounts is ₹30 lakh.

SCSS can be opened at any Post Office or authorised bank branch across the country, making it easily accessible.

Interest Rate & Tenure

Current Rate: 8.2% per annum, one of the highest safe interest rates available in India.

Payout: Interest is paid quarterly — ideal for regular income.

Tenure: 5 years, with an option to extend for 3 more years.

Once you lock in your SCSS rate, you enjoy that rate for the full tenure (even if future rates fall).

Cons / Limitations

Deposit limit: Capped at ₹30 lakh, which may be restrictive for HNI retirees.

No monthly payout: Some seniors may need monthly income (this pays quarterly).

Penalties: Premature closure penalties apply.

Despite these, SCSS remains one of the strongest low-risk, high-return choices for senior citizens.

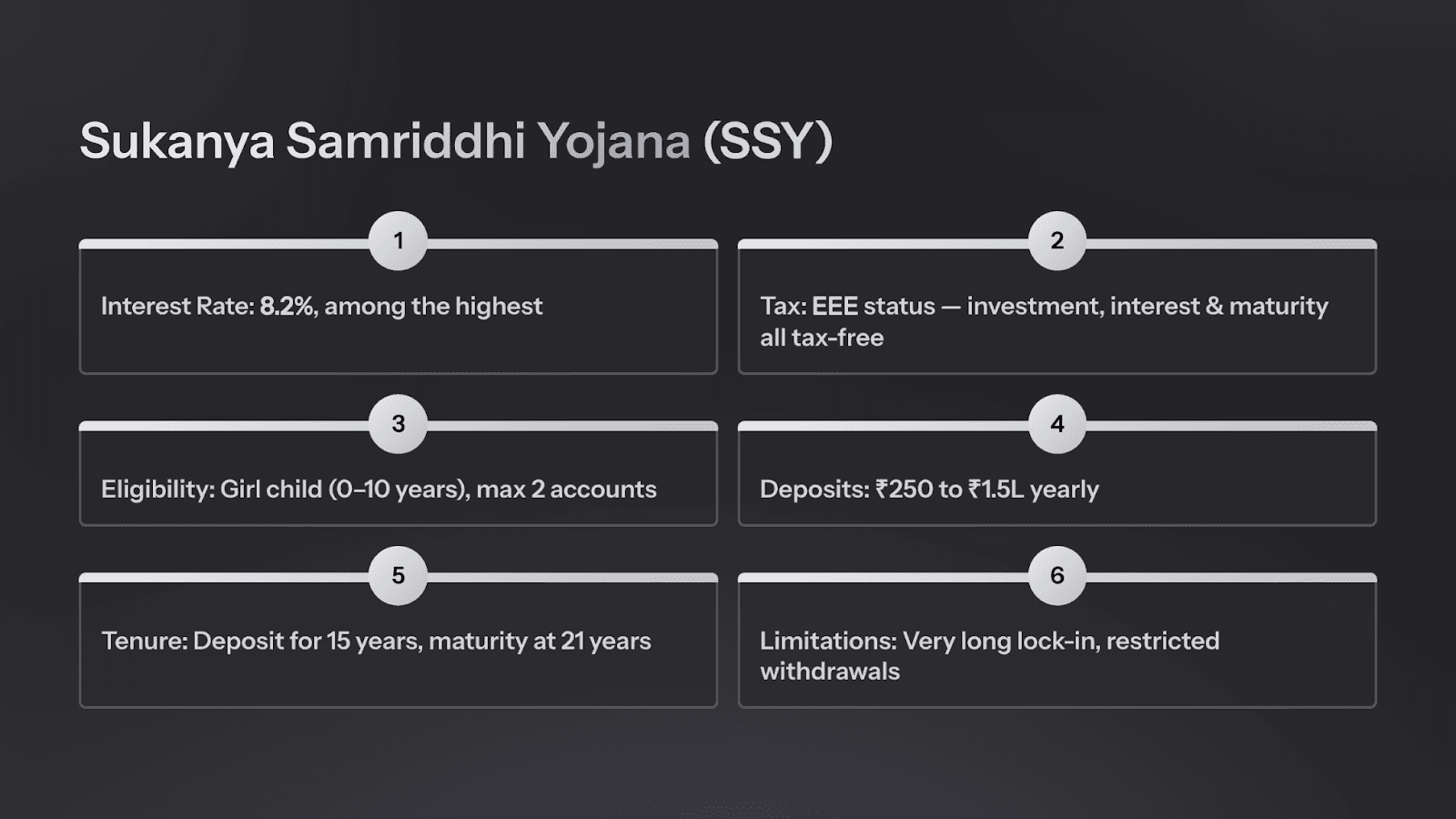

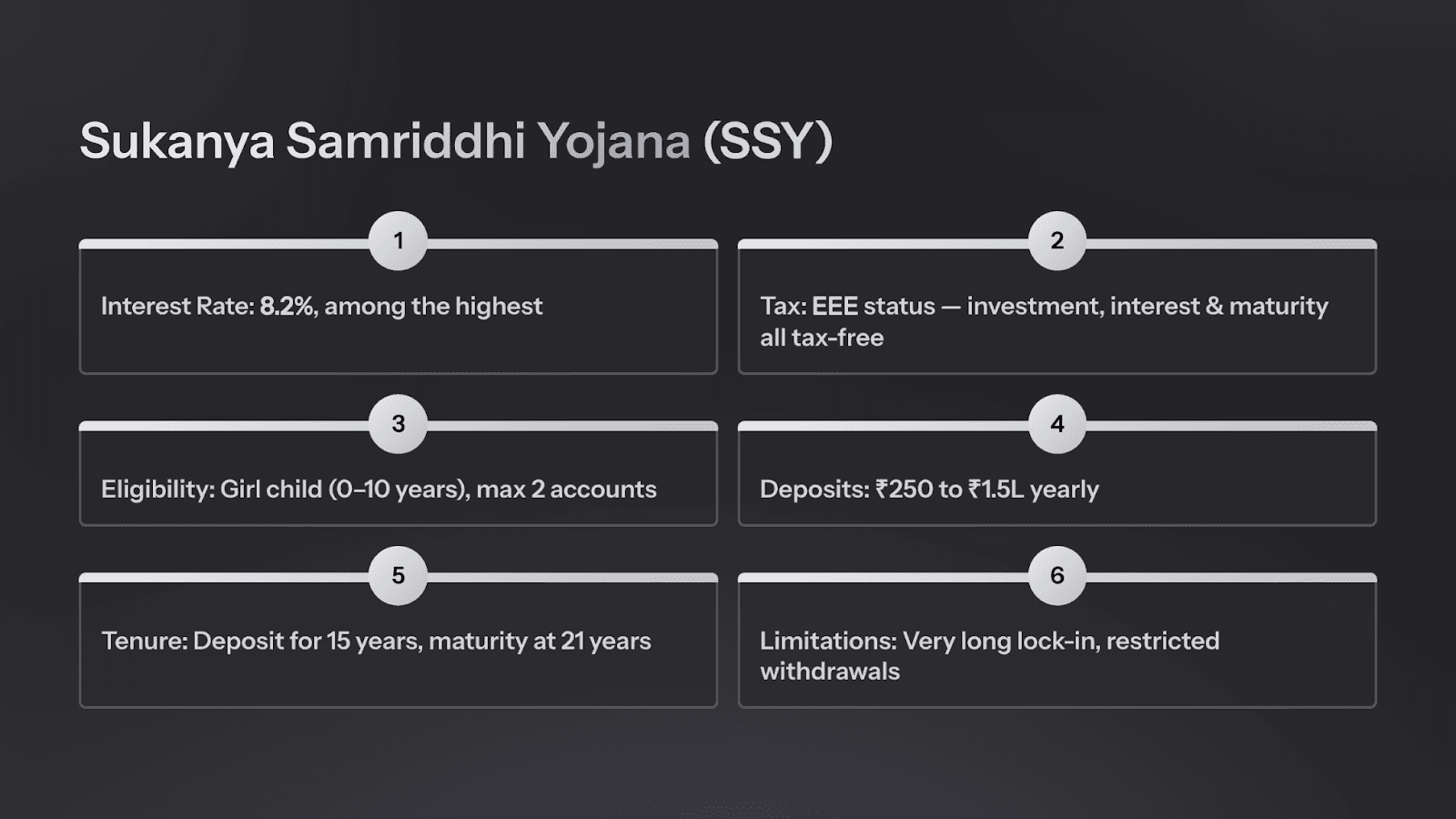

3. Sukanya Samriddhi Yojana (SSY)

Sukanya Samriddhi Yojana is one of India’s most rewarding and secure long-term savings schemes, created exclusively for the financial future of a girl child. It stands out because it consistently offers one of the highest interest rates among all small-savings schemes.

SSY also offers the rare EEE tax benefit:

Investment qualifies for Section 80C deduction

Interest earned is tax-free

Maturity amount is completely tax-free

Parents can open an SSY account anytime from the birth of their daughter until she turns ten.

Only one account is allowed per girl child, with a maximum of two accounts per family (except in the case of twins).

The scheme is flexible; families can deposit as little as ₹250 per year and up to ₹1.5 lakh annually, making it suitable for all income levels.

Interest Rate & Tenure

Current Rate: 8.2% per annum (among the highest safe returns).

Deposits: 15 years from the date of opening.

Maturity: 21 years from the date of opening.

Deposits stop after 15 years, but interest continues until year 21.

This makes SSY ideal for long-term wealth creation for a girl child’s higher education, career, or marriage expenses.

Cons / Limitations

Very long lock-in: Money is tied up until the girl turns 21 (partial withdrawals allowed only after age 18 for education).

Liquidity: Premature closure is allowed only under specific circumstances (e.g., medical or financial hardship).

Despite these, SSY remains one of the best long-term, risk-free, tax-free investments available in India.

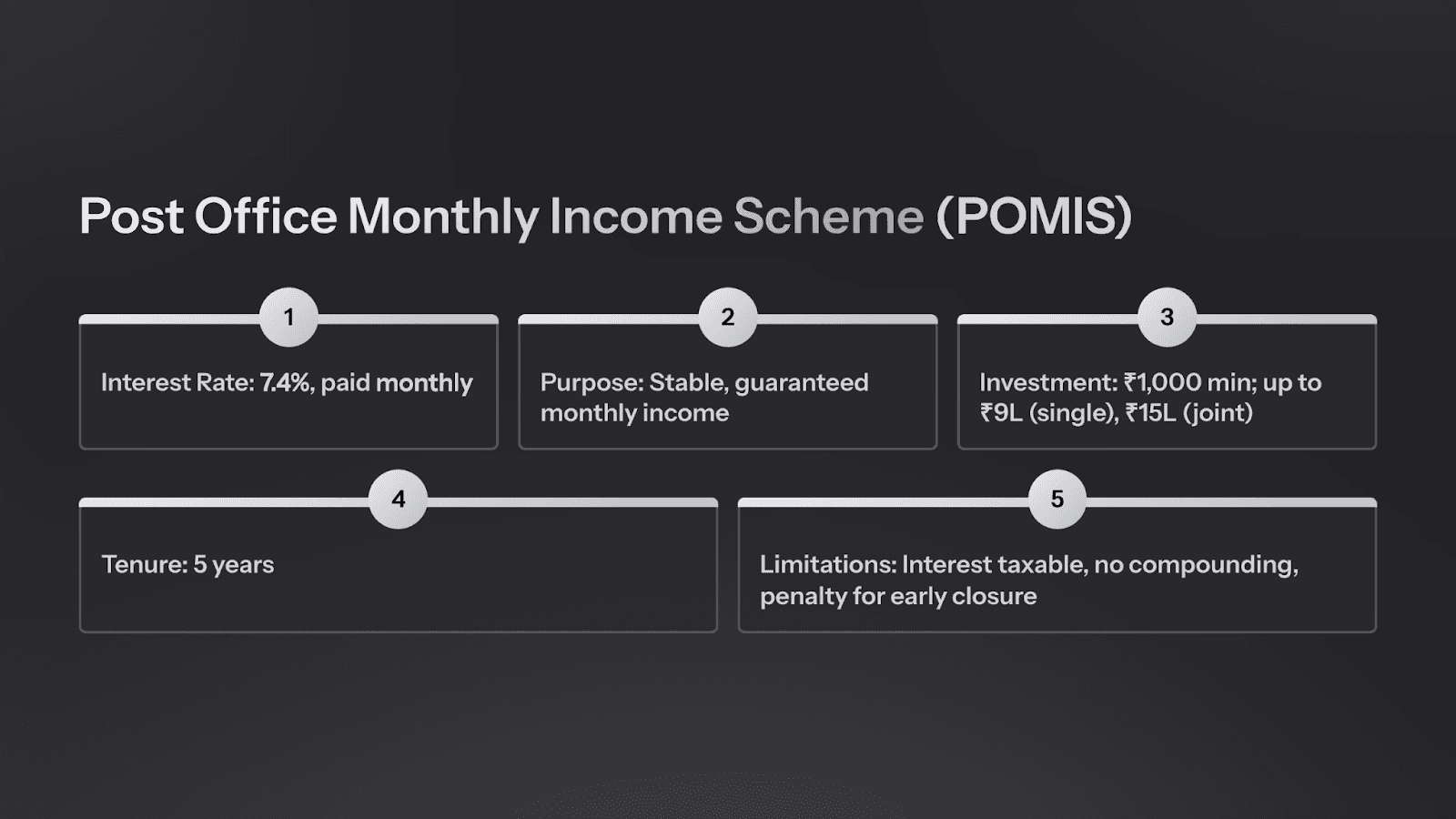

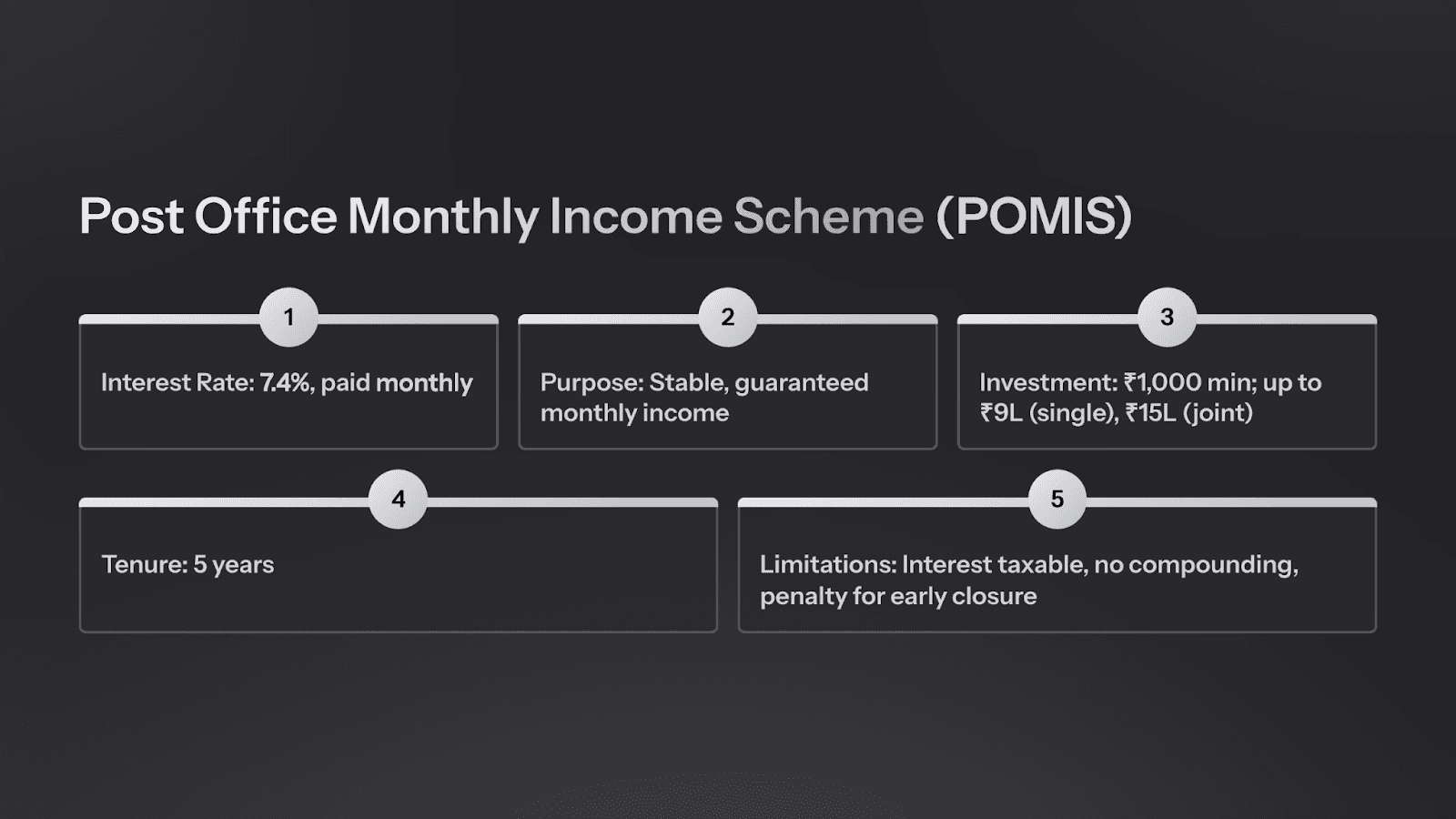

4. Post Office Monthly Income Scheme (POMIS)

The Post Office Monthly Income Scheme is designed with a single purpose in mind:

To provide a guaranteed, stable monthly income without any market risk.

You can start a POMIS account with a minimum deposit of ₹1,000.

The maximum investment allowed is ₹9 lakh for a single account and ₹15 lakh for a joint account.

Once the account is active, the interest you earn is credited directly to your savings account every month, giving you a steady and reliable source of income without the need for any follow-up or manual withdrawal.

Interest Rate & Tenure

Current Rate: 7.4% per annum (paid out monthly).

Tenure: 5 years.

Cons / Limitations

Interest is taxable, reducing post-tax returns.

No compounding since interest is paid monthly.

5-year lock-in (premature closure allowed only after 1 year with penalty).

Despite these limitations, POMIS remains a strong choice for anyone needing stable, safe, and regular monthly income without market dependence.

5. RBI Floating Rate Savings Bond (FRSB)

The RBI Floating Rate Savings Bond is one of the safest investment options in India because it is issued and fully backed by the Reserve Bank of India.

The minimum investment starts at ₹1,000 and there is no maximum limit.

Its biggest strength is that the interest rate resets every six months, giving you protection when overall market rates rise.

It offers steady interest payouts without any market volatility and carries a full sovereign guarantee — even safer than a bank FD.

The bond can be purchased easily through designated banks, making it a rare combination of absolute safety and rate protection.

Interest Rate & Tenure

Current Rate: ~8.05% (varies every 6 months).

Tenure: 7 years.

Payout: Interest is paid half-yearly.

This structure allows your returns to rise when interest rates rise, unlike fixed FDs that remain locked.

Cons / Limitations

Interest is fully taxable.

Rates may fall if interest rates in the economy drop.

No liquidity — these bonds are not tradable or transferable.

Despite these limitations, the RBI Floating Rate Savings Bond remains one of the safest long-term interest-bearing instruments for conservative investors.

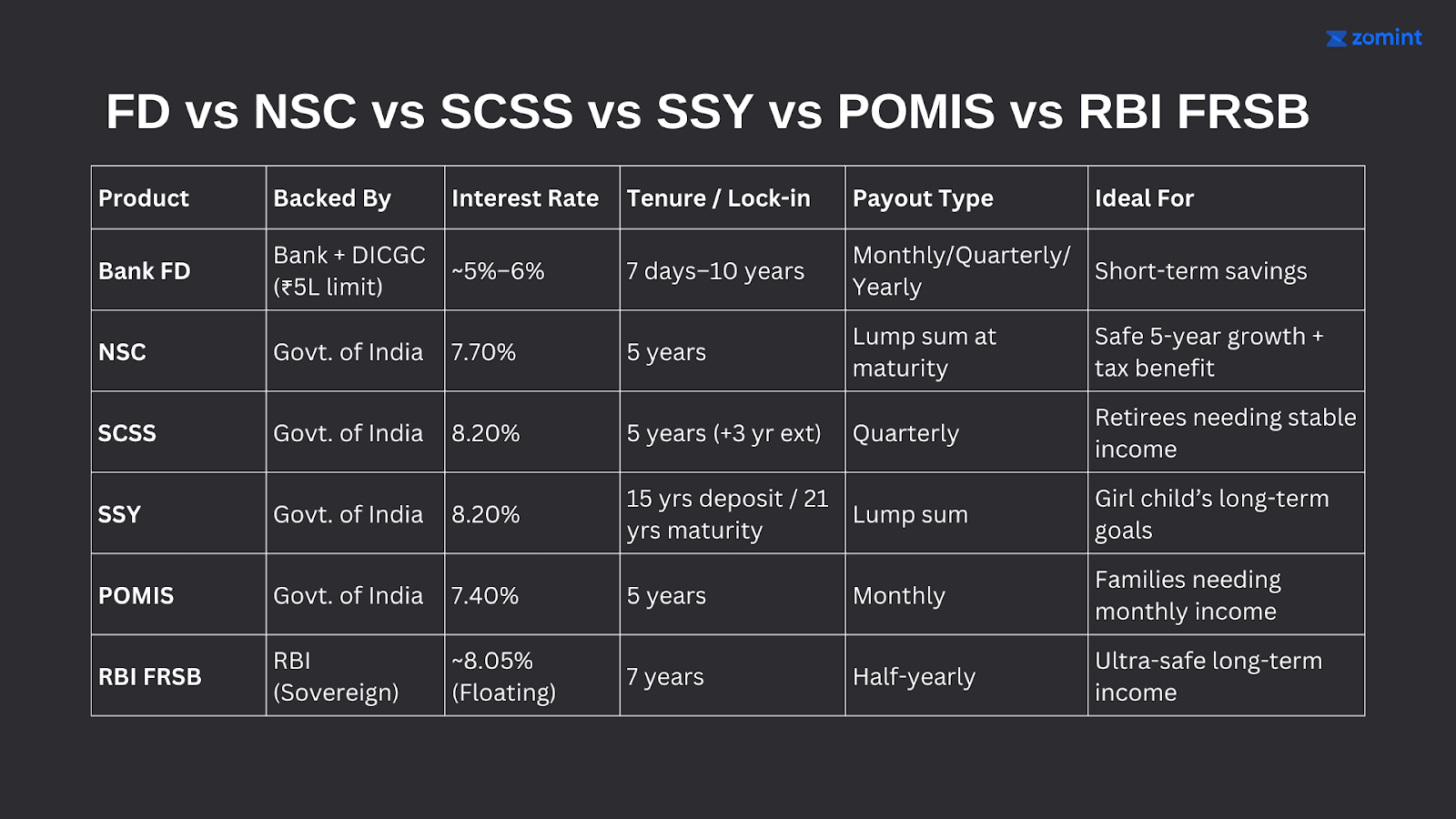

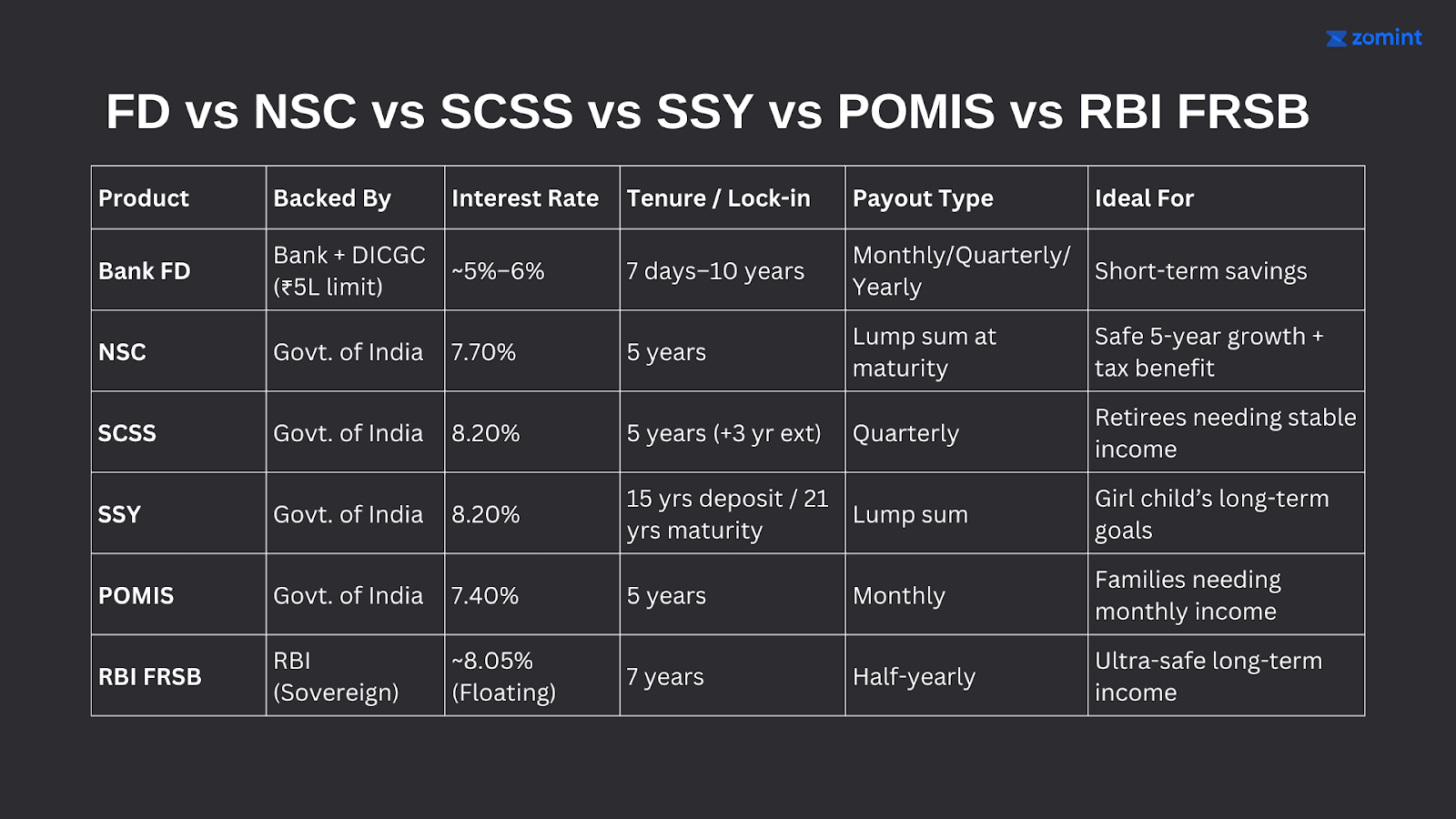

FD vs NSC vs SCSS vs SSY vs POMIS vs RBI FRSB

Product | Backed By | Interest Rate | Tenure / Lock-in | Payout Type | Ideal For |

Bank FD | Bank + DICGC (₹5L limit) | ~5%–6% | 7 days–10 years | Monthly/Quarterly/Yearly | Short-term savings |

NSC | Govt. of India | 7.7% | 5 years | Lump sum at maturity | Safe 5-year growth + tax benefit |

SCSS | Govt. of India | 8.2% | 5 years (+3 yr ext) | Quarterly | Retirees needing stable income |

SSY | Govt. of India | 8.2% | 15 yrs deposit / 21 yrs maturity | Lump sum | Girl child’s long-term goals |

POMIS | Govt. of India | 7.4% | 5 years | Monthly | Families needing monthly income |

RBI FRSB | RBI (Sovereign) | ~8.05% (Floating) | 7 years | Half-yearly | Ultra-safe long-term income |

Conclusion

FDs are not bad — but using only FDs means missing out on safer opportunities that can grow your money faster and protect your future better.

The smart approach is to combine these options based on your goals, life stage, and risk comfort.

If you’re unsure which one fits your personal goals, consider discussing it with a SEBI-registered expert who can guide you with clarity and unbiased advice.

👉 Book a free call now with a SEBI-registered expert to clarify all your doubts.

Most Indians trust bank Fixed Deposits (FDs) for one simple reason — Guaranteed returns.

But here’s the hidden truth:

The rise in daily living costs (inflation) and the tax you pay on FD interest can quietly eat away your returns.

For example, a 6% FD doesn’t actually give you 6% in hand.After tax (say 30%), your effective return falls to ~4.2%.

If you compare this with inflation at ~5%, you are actually losing money by keeping your savings in an FD.

Now, regarding safety, your money is not even entirely safe.Your bank deposits are insured only up to ₹5 lakh per bank (principal + interest) by the DICGC. That means if you have an FD of 1 crore rupees and your bank collapses, you will only receive 5 lakhs.

The Good News?

There are several government-backed saving schemes that often pay higher interest than FDs while offering equal or even higher safety.

In this newsletter, we will break down 5 such schemes.

5 Government Schemes That Are Safer Than FDs and Give Better Returns

1. National Savings Certificate (NSC)

The National Savings Certificate (NSC) is one of the simplest and most trusted small-savings schemes in India. It is available across all Post Offices in the country.

You can start an NSC with as little as ₹1,000, and there is no upper limit on how much you can invest.

The account can be opened individually or jointly, which gives families flexibility.

Another useful feature is that banks often accept NSC certificates as collateral, allowing you to take a loan against them.

The principal amount invested in NSC qualifies for a Section 80C tax deduction of up to ₹1.5 lakh in a financial year.However, the interest earned is taxable on maturity.

Interest Rate & Tenure

Current Rate: 7.7% per annum, fixed for the full 5-year tenure.

The interest is compounded annually but paid out only at maturity.

Cons / Limitations

5-year lock-in: No premature closure except in rare cases (e.g., death of the holder).

Taxable Interest: Though the principal qualifies for 80C, the interest does not.

No regular income: Full payout happens only at maturity.

2. Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme (SCSS) is one of the highest and safest income options available for retirees in India. It is designed specifically for senior citizens, which is why the government offers such an attractive interest rate.

Anyone aged 60 and above can open an SCSS account. Individuals aged 55 to 60 who have retired early can also apply.

The account can be opened individually or jointly, although joint accounts are allowed only with a spouse.

Investors can start with as little as ₹1,000, and the maximum combined deposit limit across all SCSS accounts is ₹30 lakh.

SCSS can be opened at any Post Office or authorised bank branch across the country, making it easily accessible.

Interest Rate & Tenure

Current Rate: 8.2% per annum, one of the highest safe interest rates available in India.

Payout: Interest is paid quarterly — ideal for regular income.

Tenure: 5 years, with an option to extend for 3 more years.

Once you lock in your SCSS rate, you enjoy that rate for the full tenure (even if future rates fall).

Cons / Limitations

Deposit limit: Capped at ₹30 lakh, which may be restrictive for HNI retirees.

No monthly payout: Some seniors may need monthly income (this pays quarterly).

Penalties: Premature closure penalties apply.

Despite these, SCSS remains one of the strongest low-risk, high-return choices for senior citizens.

3. Sukanya Samriddhi Yojana (SSY)

Sukanya Samriddhi Yojana is one of India’s most rewarding and secure long-term savings schemes, created exclusively for the financial future of a girl child. It stands out because it consistently offers one of the highest interest rates among all small-savings schemes.

SSY also offers the rare EEE tax benefit:

Investment qualifies for Section 80C deduction

Interest earned is tax-free

Maturity amount is completely tax-free

Parents can open an SSY account anytime from the birth of their daughter until she turns ten.

Only one account is allowed per girl child, with a maximum of two accounts per family (except in the case of twins).

The scheme is flexible; families can deposit as little as ₹250 per year and up to ₹1.5 lakh annually, making it suitable for all income levels.

Interest Rate & Tenure

Current Rate: 8.2% per annum (among the highest safe returns).

Deposits: 15 years from the date of opening.

Maturity: 21 years from the date of opening.

Deposits stop after 15 years, but interest continues until year 21.

This makes SSY ideal for long-term wealth creation for a girl child’s higher education, career, or marriage expenses.

Cons / Limitations

Very long lock-in: Money is tied up until the girl turns 21 (partial withdrawals allowed only after age 18 for education).

Liquidity: Premature closure is allowed only under specific circumstances (e.g., medical or financial hardship).

Despite these, SSY remains one of the best long-term, risk-free, tax-free investments available in India.

4. Post Office Monthly Income Scheme (POMIS)

The Post Office Monthly Income Scheme is designed with a single purpose in mind:

To provide a guaranteed, stable monthly income without any market risk.

You can start a POMIS account with a minimum deposit of ₹1,000.

The maximum investment allowed is ₹9 lakh for a single account and ₹15 lakh for a joint account.

Once the account is active, the interest you earn is credited directly to your savings account every month, giving you a steady and reliable source of income without the need for any follow-up or manual withdrawal.

Interest Rate & Tenure

Current Rate: 7.4% per annum (paid out monthly).

Tenure: 5 years.

Cons / Limitations

Interest is taxable, reducing post-tax returns.

No compounding since interest is paid monthly.

5-year lock-in (premature closure allowed only after 1 year with penalty).

Despite these limitations, POMIS remains a strong choice for anyone needing stable, safe, and regular monthly income without market dependence.

5. RBI Floating Rate Savings Bond (FRSB)

The RBI Floating Rate Savings Bond is one of the safest investment options in India because it is issued and fully backed by the Reserve Bank of India.

The minimum investment starts at ₹1,000 and there is no maximum limit.

Its biggest strength is that the interest rate resets every six months, giving you protection when overall market rates rise.

It offers steady interest payouts without any market volatility and carries a full sovereign guarantee — even safer than a bank FD.

The bond can be purchased easily through designated banks, making it a rare combination of absolute safety and rate protection.

Interest Rate & Tenure

Current Rate: ~8.05% (varies every 6 months).

Tenure: 7 years.

Payout: Interest is paid half-yearly.

This structure allows your returns to rise when interest rates rise, unlike fixed FDs that remain locked.

Cons / Limitations

Interest is fully taxable.

Rates may fall if interest rates in the economy drop.

No liquidity — these bonds are not tradable or transferable.

Despite these limitations, the RBI Floating Rate Savings Bond remains one of the safest long-term interest-bearing instruments for conservative investors.

FD vs NSC vs SCSS vs SSY vs POMIS vs RBI FRSB

Product | Backed By | Interest Rate | Tenure / Lock-in | Payout Type | Ideal For |

Bank FD | Bank + DICGC (₹5L limit) | ~5%–6% | 7 days–10 years | Monthly/Quarterly/Yearly | Short-term savings |

NSC | Govt. of India | 7.7% | 5 years | Lump sum at maturity | Safe 5-year growth + tax benefit |

SCSS | Govt. of India | 8.2% | 5 years (+3 yr ext) | Quarterly | Retirees needing stable income |

SSY | Govt. of India | 8.2% | 15 yrs deposit / 21 yrs maturity | Lump sum | Girl child’s long-term goals |

POMIS | Govt. of India | 7.4% | 5 years | Monthly | Families needing monthly income |

RBI FRSB | RBI (Sovereign) | ~8.05% (Floating) | 7 years | Half-yearly | Ultra-safe long-term income |

Conclusion

FDs are not bad — but using only FDs means missing out on safer opportunities that can grow your money faster and protect your future better.

The smart approach is to combine these options based on your goals, life stage, and risk comfort.

If you’re unsure which one fits your personal goals, consider discussing it with a SEBI-registered expert who can guide you with clarity and unbiased advice.

👉 Book a free call now with a SEBI-registered expert to clarify all your doubts.